The RBA's 3.0% growth projections for 2016 have been the key drivers for the policy outlook; while developments in the terms of trade and the exchange rate will bear careful watching in the early part of 2016.

The Q3 national accounts put a slightly better spin on the economy than had generally been anticipated. That validated the RBA's on hold stance in the H2 of 2015 and should remove any last vestiges of hope that rates would be lowered in February.

Traders tend to view the put ratio back spread as a bear strategy, because it employs puts. However, it is actually a volatility strategy.

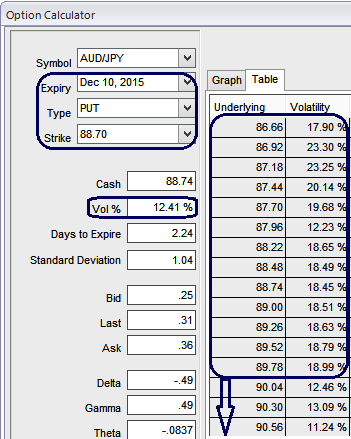

The implied volatility of 3D ATM put contract is at 12.41% and it is quite higher side which is good sign for option writers.

Based on volatility and time decay, the strategy is a "price neutral" approach to options, and one that makes a lot of sense.

As the options with a higher IV cost more, intuitively due to the higher likelihood of the market 'swinging' in your favor.

As we expect the underlying currency exchange rate of AUDJPY to make a larger move on the downside. As shown in the figure purchase 3 lots of 1W At-The-Money -0.52 delta puts and simultaneously short 3D 2 lots of (1%) In-The-Money put option with positive theta.

Entering into OTM AUDJPY position which has higher implied volatility and expecting for the inevitable adjustment is a smart approach, expecting the southward direction price movement.

You can trade the IV value by monitoring an IV chart for a specific underlying market for a certain time period and determine the IV range.

The peaks suggest the option is expensive to buy and the troughs suggest the option is inexpensive.

It is important to note you cannot compare the IV values of different options.

FxWirePro: AUD/JPY 3D ATM IV favors put writers – 3:2 PRBS portrays to mine max leverage

Tuesday, December 8, 2015 9:26 AM UTC

Editor's Picks

- Market Data

Most Popular