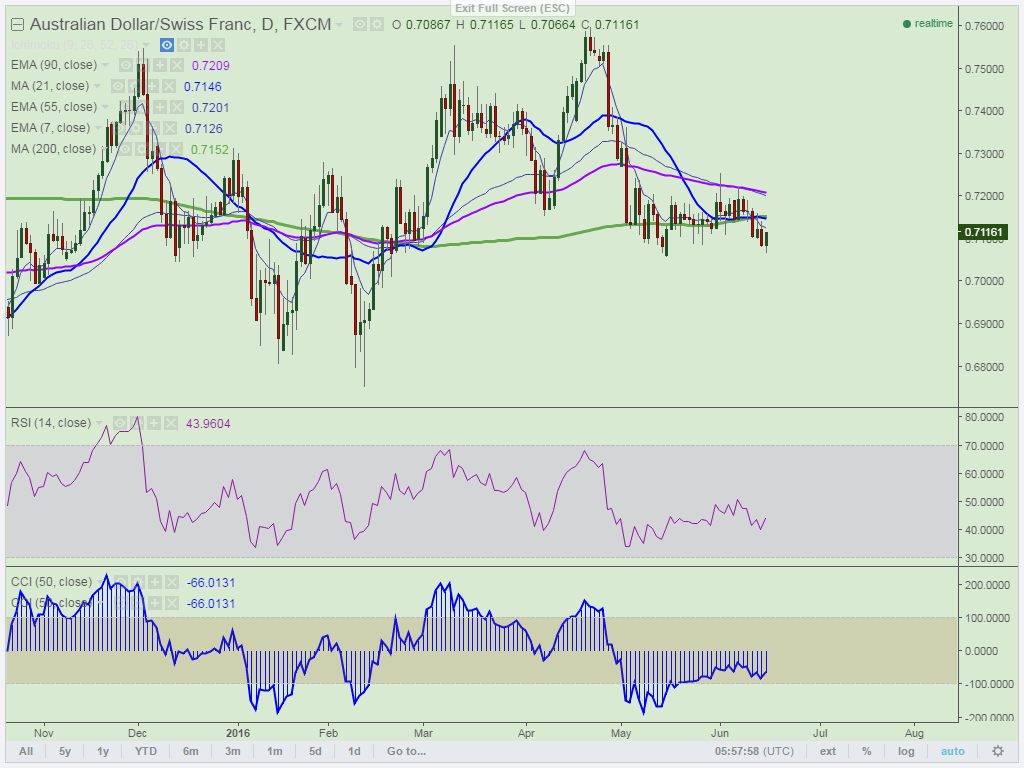

- Major resistance- 0.7210 (90 day EMA)

- Major support - 0.7050 (May 16th low)

- The pair has taken support near 0.7050 and recovered from that level. It is currently trading around 0.71070.

- Short term trend is slightly weak as long as resistance 0.7210 (90 day MA) holds.

- On the lower side any break below 0.7050 will drag the pair down till 0.7000/0.6935 (161.8% retracement of 0.70586 and 0.72559).

- The pair’s minor resistance is around 0.7160 (daily Tenkan-Sen) and any violation above 0.7160 will take the pair to next level at 0.7185/0.7215.

It is good to sell on rallies around 0.7155 with SL around 0.7225 for the TP of 0.7000/0.6932