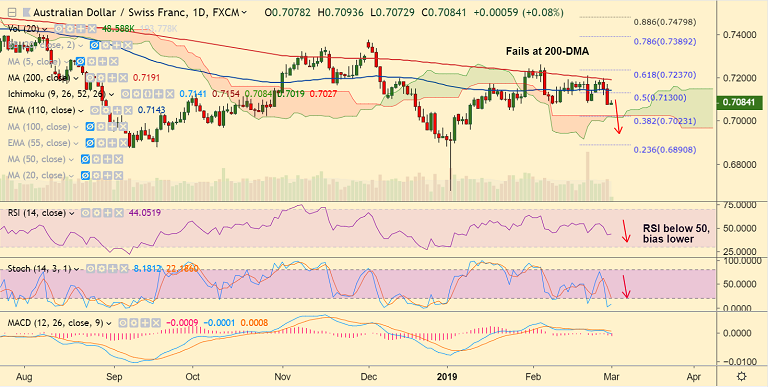

AUD/CHF chart on Trading View used for analysis

- AUD/CHF pauses downside, trades 0.18% higher at 0.7091 at 0800 GMT.

- The pair is consolidating previous session slump, bias remains bearish.

- Upbeat China data lending some support to the Aussie. China's February Caixin manufacturing PMI came in at 49.9 beating expectations at 48.5 and compared to 48.3 last.

- The pair has been rejected at 200-DMA and we see upside only on break above.

- RSI and Stochs are biased lower and price has slipped below major EMAs.

- We see weakness till daily cloud. Bearish invalidation on retrace above 200-DMA.

Support levels - 0.7076 (Feb 8 low), 0.7027 (daily cloud)

Resistance levels - 0.71, 0.7128 (55-EMA), 0.7191 (200-DMA)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-AUD-CHF-fails-at-200-DMA-good-to-stay-short-on-rallies-1504703) has hit TP1.

Recommendation: Book partial profits at lows, stay short for further weakness.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.