Currency Option Strategy: How does AUD/CAD put backspread serve volatility objective

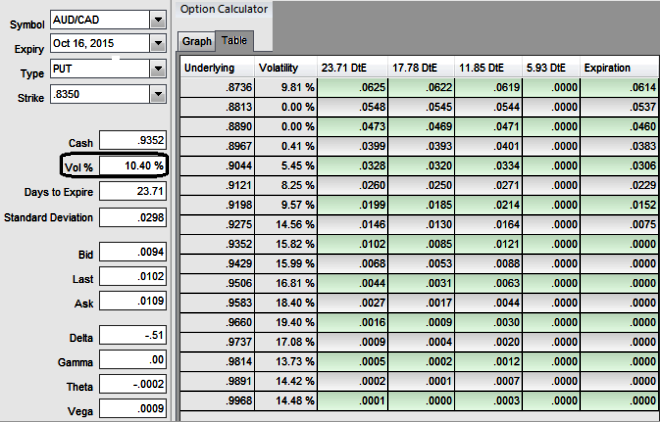

With IV of ATM contracts of this month expiry being marginally inching higher (at around 10.40%), so, add longs on 2 lots of At-The-Money -0.50 delta and simultaneously short 1 lot of ITM put with shorter expiry and now expect the underlying currency AUDCAD to make a large move on the downside.

Traders tend to view the put ratio backspread as a bear strategy, because it employs puts. However, it is actually a volatility strategy.

So usually executing the position when implied volatility of above options is high and waiting for the inevitable adjustment is a smart approach, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a "price neutral" approach to options, and one that makes a lot of sense.

How could it serve volatility objective: But IV of ATM contracts AUDCAD has just been slightly inching over 10.30% or so, hence, the position is a spread with limited loss potential, but varying profit potential. The degree of profit relies on the strength and rapidity of price movement. The position uses long and short puts in a ratio, such as 2:1 or 3:2, to maximize returns. In most long/short spreads, you make money if the pair moves, but you lose if it remains in the middle "loss zone." A ratio put backspread is different because it creates a net credit, so even if the stock price does not move very much, you keep the credit if all of the puts expire worthless.

FxWirePro: AUD/CAD put backspreads not only a bearish weapon but a volatility measure

Wednesday, September 23, 2015 8:10 AM UTC

Editor's Picks

- Market Data

Most Popular