- AUD/CAD is up 0.32% on the day, currently trading at 0.9764, bias higher.

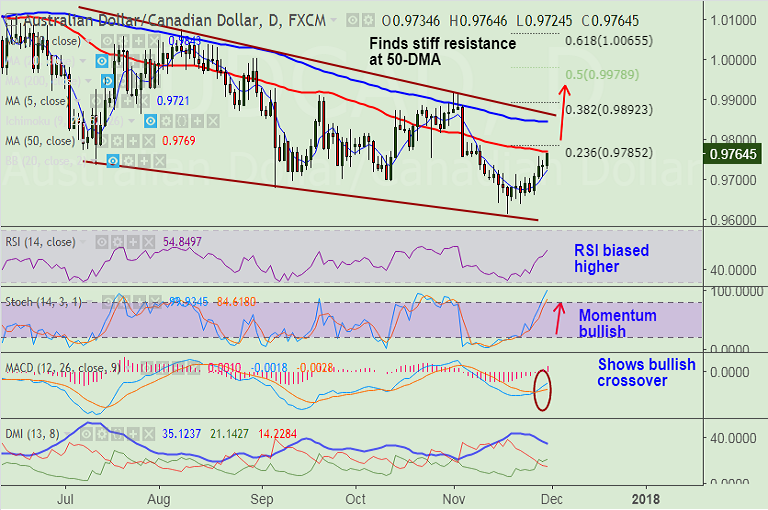

- The pair has broken 20-DMA and now finds stiff resistance at 50-DMA at 0.9769.

- Technical indicators support upside in the pair and we see scope for test of 200W SMA at 0.9837 on break above 50-DMA.

- Momentum indicators are bullish, RSI is above 50 levels and rising, MACD shows bullish crossover on signal line.

- We also evidence a bullish +ve DMI crossover on -ve DMI, but ADX does not support trend higher, so caution advised.

Support levels - 0.9721 (5-DMA), 0.9714 (20-DMA), 0.97 (Sept 24 low)

Resistance levels - 0.9769 (50-DMA), 0.9785 (23.6% Fib retrace of 1.0345 to 0.9612 fall), 0.9837 (200W SMA)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-AUD-CAD-Trade-Idea-1024326) is approaching final targets.

Recommendation: Book partial profits at highs, raise trailing stop to 0.9720, watch out for break above 100-DMA, target 0.98/ 0.9835.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -9.72586 (Neutral), while Hourly CAD Spot Index was at -40.3072 (Neutral) at 0540 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest