Of late, MXN seemed to be extending recovery threatening upper bound of recent range.

But the previous massive sell-off of Mexican peso caused a vol surface dislocation, nudging skews to the highest since the 2016 US Presidential elections. Delta hedged 1*1.5 ratio call spreads exploit the dislocation while also having historically offered a superb performance. +1Y/-3M calendars of risk reversals take advantage of the lagging back-end vs front-end implied skews.

The structure would benefit from a quiet(ish) price action on MXN, with the spot preferably drifting higher or at least remaining around current levels. While the current richness of the riskies is helping to tilt the risk-reward favourably, a few notable risks remain. Namely, selling topside calls exposes the seller to negative impact from realizing spot-vol correlation in the event of a sell-off, while better sentiment could expose the long downside (ATMF) call leg to softer realized vols on lower spot levels. Note that realized spot-vol correlation is performing; however, the trailing nature (3m rolling window) of the realized measure (compared to the forward looking implied measure) makes it less relevant for forecasting future performance. In order to mitigate the risk from spot-vol correlation continuing to perform, 6M or longer maturities could be good candidates for implementing the trade, offering the opportunity of closing then once a given P&L target on lower implied skews has been reached.

With the above in mind, we take the opportunity to analyse what generally works on the MXN vol surface, on a back-tested basis and from a pure vol standpoint. 2nd chart analyses a variety of structures, all for 6M maturities. For instance, selling RRs (delta-hedged) works orders of magnitude better than selling ATM vol (refer 2nd chart - bottom, Sharpe Ratio of 0.87 vs. 0.15 over past 5-yrs). Better yet, 1*1.5 ratio USDMXN call spreads (delta-hedged) have been notably a high Sharpe Ratio (1.66) trade to hold over the years. Being long ATM vs. short OTM calls at near vega neutral notionals, the 1*1.5 ratio call spread structure is also well positioned to be selling topside OTM vols, which now are priced heftily after the latest vol explosion.

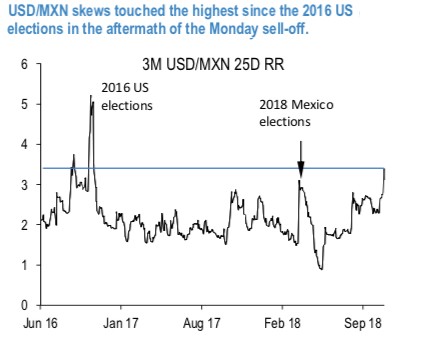

The peso sell-off triggered a vol surface dislocation, pushing gamma vols to 15.3 handle, the highest since June, and an even quicker reaction of front-end skews, reaching the highest since the 2016 US Presidential elections (refer 1st chart). The back of the vol curve is lagging the move, with 12M / 3M 25D risk reversals vol ratio at a multi month low. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at 0 (which is absolutely neutral), while articulating at (10:08 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close