GBP continues to be out of fashion, having weakened 10% on a trade-weighted basis post-Brexit.

BoE meeting Thursday main event. We and consensus look for a 25bps cut, and will look closely at the inflation report to see BoE’s take on Brexit consequences

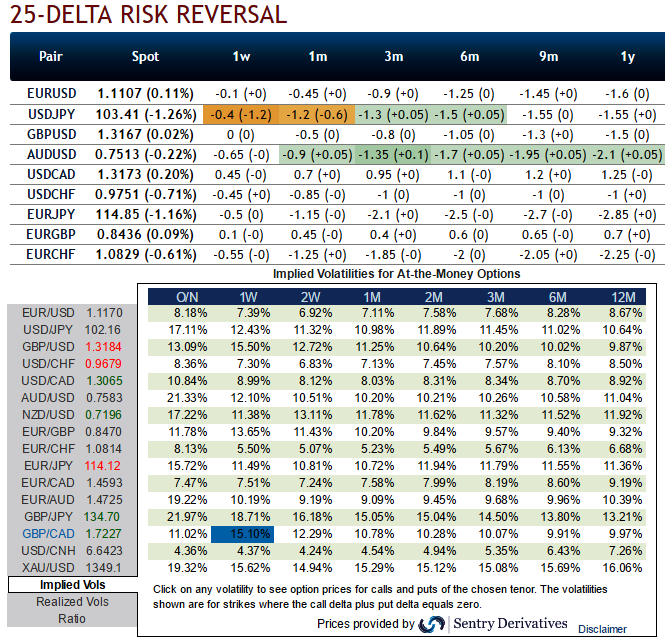

Delta risk reversals of EURGBP: From the nutshell showing delta risk reversals of EURGBP, you can probably make out that the pair has been one of the most expensive pairs to be hedged for upside risks as it indicates calls have been relatively costlier over puts.

As it showed the 2nd highest positive values (after USDCAD) which indicate upside risks of spot FX is anticipated and hedging for such risks is relatively more expensive.

Needless to specify, GBP vols have still been flying with sky rocketed pace no matter what both prior and post Brexit event, but this time these IVs are also owing to BOE’s monetary policy decision.

Post Brexit adjustments saw leveraged funds reduce their net long USD positions for the week ending 28 June. This was despite the DXY rallying following the Brexit result. The USD selling was broad based against all the major currencies.

Whereas on GBP side, further into 2016, there are two key risks associated with sterling – the UK’s unsustainable current account deficit and the post-Brexit formalities promised for end-2017 at the latest.

The OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon as hedgers have been cautious on long-term downtrend that has lasted since mid-April 2013 and as a result delta risk reversal for GBPUSD was turning into negative, while the UK current account balance data go back to 1946. The annual deficit (just over £100bn in 2015) didn’t get above £1bn in a single year until 1973, so we reckon the pre-1946 story can be largely ignored. Since 1946, the cumulative deficit is £881bn, and it’s getting bigger and bigger.

This isn’t the only part of the UK balance of payments that is, at first blush, confusing. The net asset position has improved, yet the income on foreign assets has deteriorated. The UK’s net foreign assets are in the hands of a small number of large multi-national companies, many in the resources sector.

The income they earn on overseas investments has fallen because too many are in sectors like energy, where prices have fallen significantly. That worsens the current account balance. But if those weak earnings simply discourage investment in more capacity in these industries, a lower dividend flowing home would be offset by reduced investment overseas in the financial account.

Hence, we think the foreign trade bills in pounds denomination are so needy to be hedged for downside risks and so is evidence in OTC hedging arrangements.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says