This week’s main focus on the US FED and RBNZ’s monetary policy announcements. The US dollar should strengthen further if the Fed hikes further this year, and that will push NZDUSD lower. The RBNZ took another step down the dovish path in the August Monetary Policy Statement, opening the door further to a rate cut scenario. The dovish signal from the RBNZ’s August MPS should resonate during the months ahead.

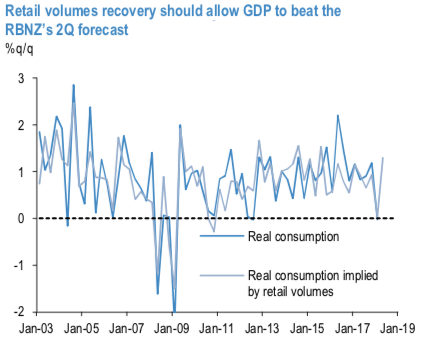

We foresee a reasonable chance of a rate cut from the RBNZ (approx. 30%), it seems likely that this is a prospect for 2019, and would require a further loss of momentum in the activity data. The RBNZ laid out a clear path to a rate cut at the August MPS, which required that growth fails to stabilize over 2Q/3Q. Recent tracking data suggest that growth will in fact beat the RBNZ’s low-ball forecast in 2Q (RBNZ 0.5% q/q), as retail volumes surged over the quarter (refer above chart).

NZD is projected to end 3Q’19 at 0.61 (previous 2Q target 0.62).Much as the global growth and reflation impulse has faded this year, the reality is that there have been important domestic drivers of NZD’s slide too.

NZD is our preferred high-beta short within G10 at present as it’s the only DM economy where the market prices a realistic chance of rate cuts over the coming year (around 10bp is priced by mid-19).

NZD is no longer expensive in outright terms (the REER is in line with a long-term average), that being said it is quite a bit more expensive than large parts of EM yet vulnerable to the same pressure from tighter US monetary policy with the additional kicker of course that NZD is now negative carry.

Stay short in NZDUSD via 2m (1%) ITM -0.49 delta put options, in the money call with a very strong delta will move in tandem with the underlying spot FX. Courtesy JPM

Currency Strength Index: FxWirePro's hourly NZD spot index is flashing at 120 levels (which is bullish), while hourly USD spot index was at -47 (bearish) while articulating at (12:19 GMT). For more details on the index, please refer below weblink:

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?