Option markets have so far been heedless to the diverging paths of RBA and RBNZ QE, and by extension to the still early-stage differentiation between AUD and NZD. Our antipodean strategists have noted the distinction between RBA (price-targeting and already tapering) and RBNZ (quantity commitment, more aggressive rhetoric around overseas asset purchases as well) QE programs, as well as New Zealand’s greater reliance on services exports (tourism in particular) as reasons to favor medium-term AUDNZD upside.

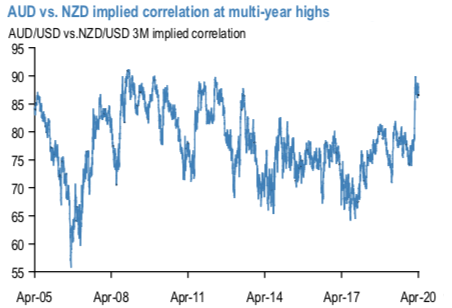

Option markets, however, continue to price AUD vs. NZD correlation in the high 80s (refer above chart), meaning that AUDNZD vol is depressed and options there can be a legitimate instrument to express bullish AUDNZD views.

One still needs to be careful in terms of not incurring too high a decay cost in such structures, given that AUDNZD ultimately is a bounded cross and not renowned for its explosive potential; hence, vanilla call spreads such as 2M 1.08/1.10s (43 bp AUD premium off 1.0690n spot ref., 4.1x max gearing, 30% discount to 2M 1.08s) are likely to suit most macro portfolios better than outright calls.

A more interesting correlation play to combine low AUDNZD vol with a view of across-the-board NZD under- performance vs. G10 FX as more aggressive RBNZ QE successfully debases the currency is to buy NZDUSD vs NZDAUD correlation swaps.

This is a permutation of the AUD vs. NZD correlation above, but reset to NZD as the pivot currency which is in the eye of RBNZ’s QE storm at present, and purports to buy a NZD-centric correlation pair which, even if not convexly geared to risk market meltdowns, has only limited room to collapse further from here at historically depressed levels.

The choice of currencies in the NZD basket in this instance is also fortuitously identical to the cash basket that the macro FX Strategy portfolio sold NZD against last week.

NZDUSD vs. NZD/AUD 1Y correlation swap is offered @ 25/34 indicatively (mid 27.6). Courtesy: JPM

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data