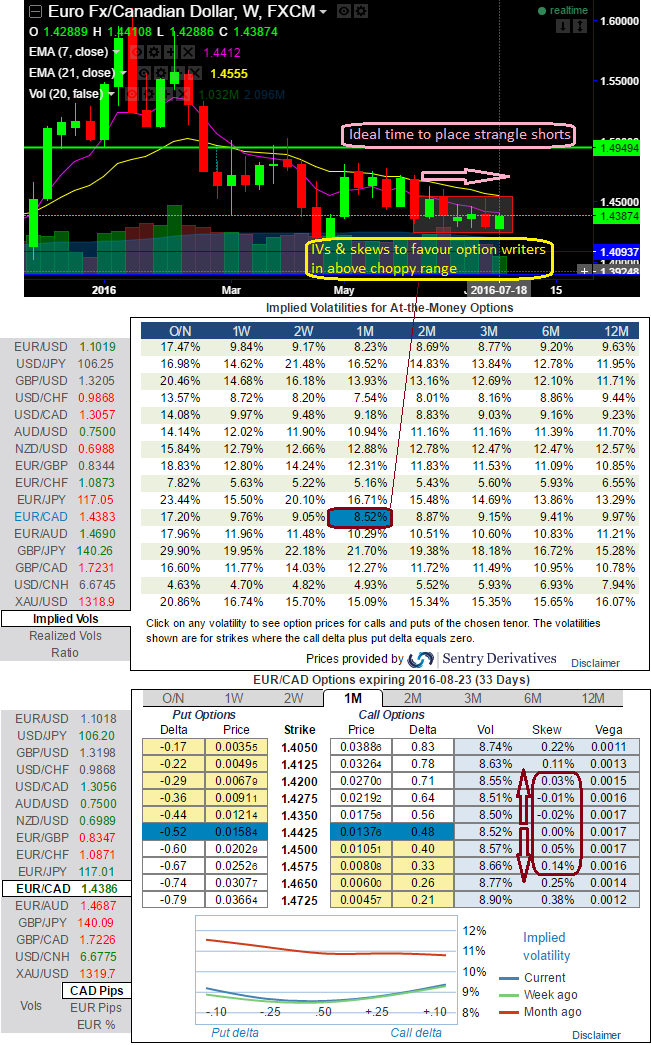

Please be noted that the 1m IVs have been tepid, a tad above 8.5%, skews in these IVs have been puzzling on either side (upper strike 1.4550 and lower strikes at 1.4240 levels.

Also, be advised that the narrow range creates the opportunity for the speculators between boundaries of the range (see weekly charts).

From the last couple of weeks, the prices have been drifting through range shown in the grey shaded areas.

Option-trade recommendation: Naked Strangle Sale

Strategy: Naked Strangle Shorting

Time frame: 7 to 10 days

Overview: Mildly bullish in the short term but sideways in the medium term.

At current spot at 1.4385 with range bounded trend keeping in consideration, we would like to remain in the safe zone by achieving certain returns though shorting a strangle.

Short 1W OTM put (1.5% strike difference referring lower cap) and short OTM call simultaneously of the same expiry (1% strike referring upper cap) (we reiterate, preferably short term for maturity is desired).

At current spot at 1.4385 the pair moving in non-directional trend and with stagnant IVs, keeping these factors into consideration we would like to place below trade positions to achieve certain returns through shorting a strangle.

Thus, stay short in 3D OTM put (1.5% strike difference referring lower cap)and short OTM call simultaneously of the same expiry (1% strike referring upper cap) (preferably the short term for maturity is desired).

Overview: Investor thinks that the underlying spot FX would not be very volatile within a broader band.

Margin: Required.

Risk/reward profile: Limited to the two premiums received. Maximum returns for the strategy is achievable when the underlying spot FX price on expiry is trading between the OTM strikes as both the instruments have to expire worthless. So that the options trader gets to keep the entire initial credit taken as profit.

Unlimited losses - should the market fall or rise greatly. If the market does little then the value of the position will benefit as the short positions gain when the option time value falls.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand