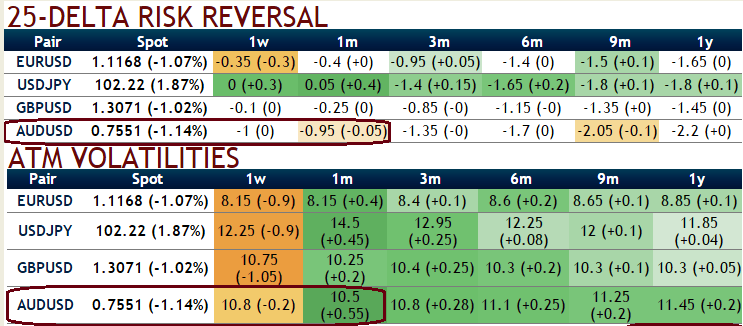

Please be noted that the resilient changes in risk reversals 1w, 1m to 3m tenors, the negative tickers in delta risk reversals in 1 month’s tenor that signify the puts are on higher demand and so priced at a higher premium than calls (which would mean that AUD’s downside protection is relatively more expensive).

Significant changes can indicate a change in market expectations for the future direction in the underlying forex spot rate.

Let’s glance through the gradual rise in IVs during 1m-3m tenors which are good news for option holders, while option writers can capitalize on 1w expiries.

July building approvals in Australia significantly rose by 11.3% from the previous flash -4.7%.

RBA’s monetary policy is scheduled in 1 week of September; the strong data challenge the RBA’s more benign view of the housing market. While we would caution against reading too much into what can be a very volatile series, the pick-up in both approvals and auction clearance rates challenges the RBA’s view that the risks of reigniting the housing market have eased, particularly with renewed strength in daily house prices in Sydney and Melbourne.

Fed’s Vice Chair Fischer will be speaking overnight (8:30pm AEST) which may drive added volatility. Any backpedalling may see an outsized rally in risk currencies, including AUD. Notably, despite a strong rally in UST today, the USD was relatively flat.

US rates rallied overnight, partially reversing Friday night’s move. Australian yields are likely to open lower.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons