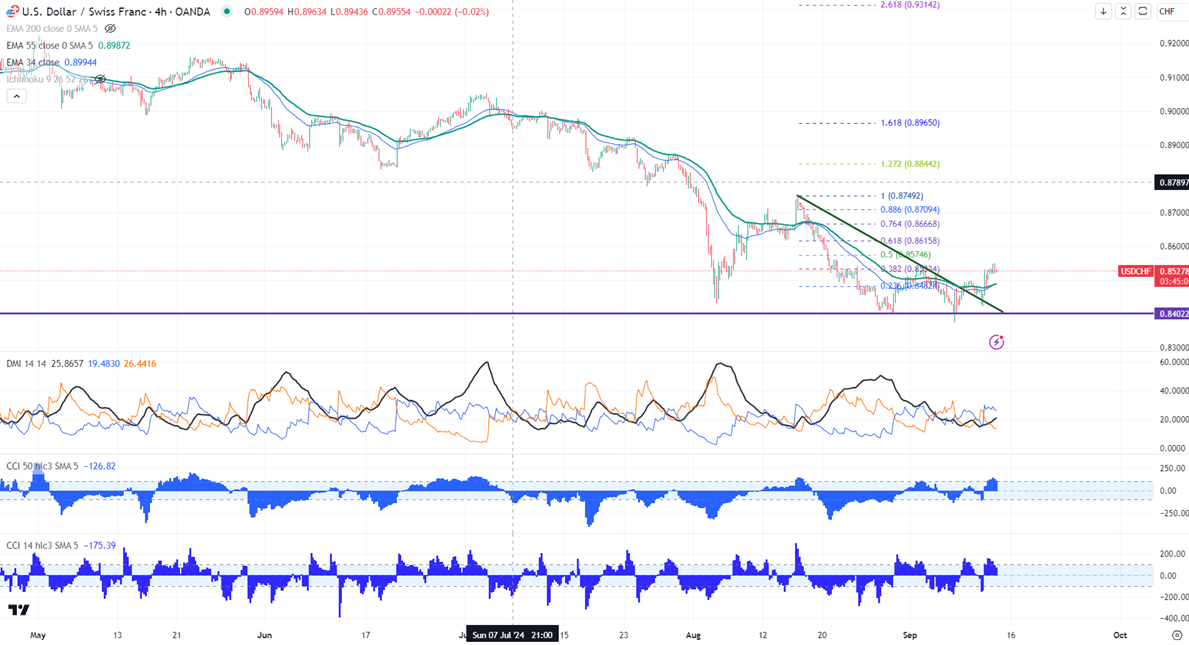

Intraday bias remains neutral as long as resistance 0.8550 holds. It hit a high of 0.85488 and is currently trading around 0.85267.

|

Time (GMT) |

Currency |

Event |

Actual |

Forecast |

Previous |

|

12:30 pm |

US |

PPI y/y |

1.7% |

1.8% |

2.2% |

|

|

|

Core PPI y/y |

2.4% |

2.5% |

2.4% |

|

|

|

PPI m/m |

0.20% |

0.10% |

0% |

|

|

|

Core PPI m//m |

0.30% |

0.20% |

0% |

|

|

US |

Unemployment claims |

230K |

227K |

228K |

Technicals-

The pair is trading above 34 and below 55 EMA in the 4-hour chart.

The near-term resistance is around 0.85360, any close above targets 0.8590/0.8635. The bearish pattern from 0.92244 will get completed at 0.8375 if the pair close above 0.8540. The immediate support is at 0.8480, any violation below will drag the pair to 0.8420/0.8400/0.8365 (61.% fib projection)/0.8340.

Indicator (4-hour chart)

CCI (14)- Bullish

CCI (50)- Bullish

Average directional movement Index - bullish.Overall trend is bullish

It is good to sell on rallies around 0.85280-300 with SL around 0.8560 for a TP of 0.8405.