Barclays notes..

- We think the March cut was likely a one-off, aimed at pre-empting a further decline in confidence, and that this reduces the risk of an additional near-term move - particularly given the degree of division among MPC members.

- The government has signaled that fiscal spending is likely to pick up more meaningfully in Q2 after the signing of public sector contracts at the end of March, and we believe this will provide more effective support for growth than further monetary stimulus.

- With that said, given the slow pace of recovery in the domestic economy, as well as benign inflation, we continue to expect monetary policy to stay accommodative for the rest of 2015.

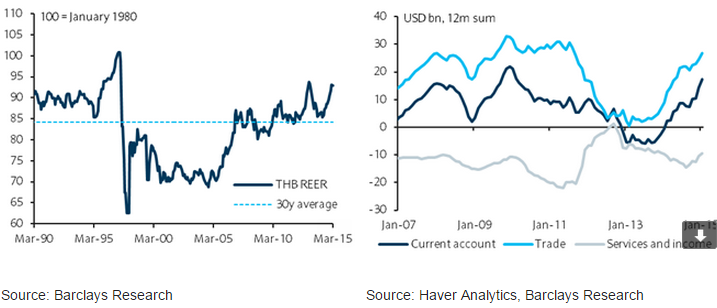

- The minutes of the BoT policy meeting revealed that the central bank is not overly concerned with the recent strength in the THB REER, and that THB outperformance was not the motivation for lowering interest rates at the March meeting.

- We see a reduced risk of rate cuts by the BoT to counter THB strength in coming months, with future decisions on monetary policy likely to be based more on growth and inflation considerations. Given this, and considering the substantial improvement in Thailand's external balance this year (2015 current account forecast of 7.9% of GDP versus 3.8% in 2014), we think THB outperformance versus other Asian FX will likely extend when the USD appreciation trend resumes after the recent pause.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX