Although the Japanese Yen continues to trade in a firm tone against the Greenback, hitting 125.86, the high since June 2002, JPY appreciation was seen against most of non-USD majors. As a result, JPY's nominal effective exchange rate has appreciated by 2.1% so far this year, following the sharp decline for three consecutive previous years. JPY seems to have found its ground in 2015, fundamentals surrounding the yen have turned positive. In addition to the meaningful changes in fundamentals, politics has become JPY-supportive as well.

The biggest change in economic fundamentals is the significant improvement in Japan's current account surplus during the year. It has already reached ¥13.1trn in the first nine months of the year, significantly higher from that in 2014, when annual surplus was merely ¥2.6trn (0.5% of GDP). Japan's current account surplus had decreased dramatically through 2014 due to the precipitous deterioration in the trade balance that began around 2011, mainly due to the surge in energy prices and the increase in imports from Asia.

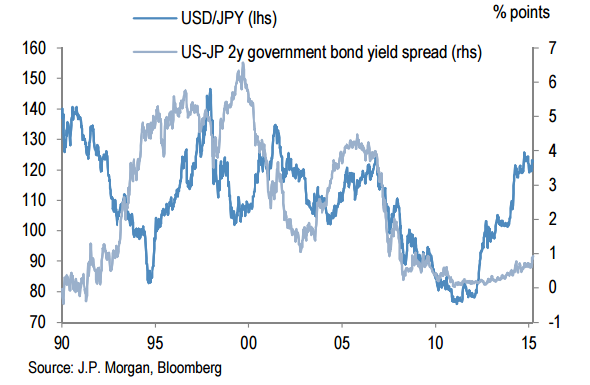

Rising expectation for future normalization of Fed's monetary policy has seen USD appreciating during the year. USD has become the strongest currency within the G-10 camp. While the BoJ on the other hand has disappointed the markets without any actions. Recent comments from the BoJ have indicated a reluctance to ease monetary policy further. The pace of QE expansion was left unchanged after the BoJ's late October policy meeting. As a result, on an aggregate basis, rate spreads between Japan and other countries have shrunk. In 2015, USD/JPY appreciation supported by wider US-Japan interest rate spread and JPY-selling from large outflows from Japanese foreign direct/portfolio investments have limited an upside of JPY in trade weighted terms, but wider US-Japan rate spreads may not lead to further USD/JPY appreciation in 2016.

At the moment, both the US and Japanese governments do not seem keen to see further USD/JPY appreciation. If political impact on the currency reinforces, the correlation between US-JP rate spreads and USD/JPY will collapse as we saw in early 1990s. Upward pressure on JPY from Japan's balance of payments is expected to strengthen in 2016, mainly due to a further increase in current account surplus, slowdown in pensions' foreign securities investments and corporates' FDI.

"In 2016, we expect JPY to appreciate against most of G-10 currencies including USD, meaning that the pace of JPY appreciation in trade-weighted terms will accelerate. We target USD/JPY at 115 for 1Q16, 117 for 2Q16, 113 for 3Q16 and 110 for 4Q16", says J.P. Morgan in a research note.

USD/JPY edged higher to 123.74 last week but lost momentum ahead. The pair is currently trading at 122.58 as at 1105 GMT.

Fundamentals look better for JPY in 2016

Friday, November 27, 2015 12:00 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022