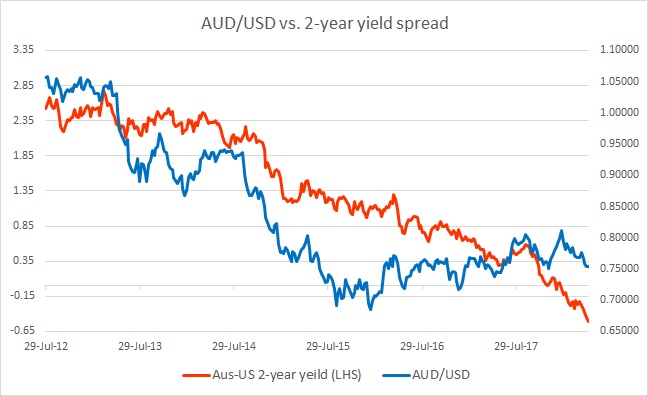

The chart above shows, how the relationship between AUD/USD and 2-year yield divergence has unfolded since 2012.

Brief background:

- It can be seen even with a naked eye, that the pair and the yield spread between 2-year treasury and 2-year Australian government bond have enjoyed a very close relationship.

- While the Reserve Bank of Australia (RBA) reduced rates after the financial crisis of 2008/09, it soon started increasing interest rates due to higher commodity prices and higher inflows from other western economies. However, as commodity prices started declining in 2011, RBA started reducing rates since the end of 2011.

- RBA reduced cash rates from 4.75 percent in 2011 to 2 percent by the summer of 2015. And the yield spread between the two countries declined from 2.53 percent 1.2 percent. During the same period, the Australian dollar declined from 1.056 against the USD to 0.728 against the dollar.

- The exchange rate bottomed in August around 0.69

- However, there has been divergence since then. Between now and the summer of 2015, the RBA reduced rates further by 50 basis points, while Fed raised rates by 100 basis points. The yield spread also declined from 120 basis points to just 46 basis points. However, the AUD/USD didn’t make further low, instead, it has moved higher from 0.728 in July 2015 to 0.795 before declining recently.

- We believe, that the expectations of a rebound in commodities as well as Chinese economy were playing parts. However, sooner or later the duo would have to converge, which we expect would come in terms of rate hikes from RBA and increase in the spread in favor of the Australian dollar.

Past Reviews:

- In our review in August, we noted that since July review, the yield spread widened in favor of the Australian dollar. The spread was then at 49 basis points, and the exchange rate is at 0.795. We expected a further correction in Australian dollar likely or the widening of spread.

- In our early October review, we noted that while the spread has barely moved but the divergence was narrowed as expected via a decline in the Australian dollar exchange rate, which was then at 0.781, down 110 pips.

- In our early November review, we noted that the divergence has somewhat widened. The yield spread has declined by 26 bps to just 16 bps favoring the dollar, while the Aussie has weakened by 30 pips and currently trading at 0.768 against the USD.

- In our next review, we noted that the spread has further declined by 13 bps to 3 bps in favor of the dollar, while the Aussie has declined by 60 pips against the dollar.

- In our mid-December review, we noted that the spread has risen from 3 basis points to 13.5 bps while Aussie has risen by almost 100 pips, to 0.771 against the dollar.

- In our January review, we noted that the spread declined by 14 bps to -0.01 bps, however, the Aussie has strengthened further by 370 pips, thus widening the divergence. The Aussie was then trading at 0.808 against the dollar.

- In our February review, we noted that the spread has further widened by 24 bps in favor of the dollar and Aussie has declined by somewhat 260 pips to 0.786 against the dollar.

- In our April review, we noted that spread further widened by 1.5 bps in favor of the dollar, while Aussie declined by 80 pips to 0.778 as of today against the dollar.

Current status:

Since the review, the spread has widened sharply by 22 bps in favor of the dollar to -51 bps, while Aussie declined by 250 pips to 0.753 as of today against the dollar.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed