Through 2015 and since the financial crisis, ETFs has gained more into prominence, in some sectors, more prominent than mutual funds, grossly surpassing asset under management. So inflows and outflows into the ETF can to some extent reveal investor sentiment and preference.

While aggregate data shows, Gold ETFs stand out in terms of inflow this year, while equities seem to have suffered worst. Investors poured $5.57 billion so far into SPDR Gold and withdrew about $5.05 billion from SPDR S&P 500.

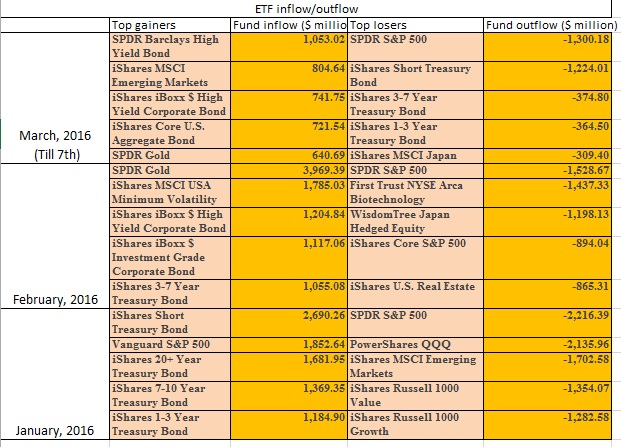

However, month wise flow reveal much clearer picture of investor sentiment.

As the attached table shows,

In January,

- Investors showed biggest preference for shorting treasury bonds, which is understandable given the drop in equities and massive volatility. Withdrew most from equities. Risk aversion trend is quite clear as investors are preferring long dated treasury ETFs, Gold ETFs, while equities and emerging market ETFs bleed.

In February,

- Risk aversion, still hovers the market, data shows equities still bleeding, while investors keep piling up big in Gold, minimum volatility ETFs. However sentiment is better than January, as investors pour money into relatively riskier corporate bonds.

In March.

- March has just began but data till 7th shows clear trends. Investors are pouring big bucks into corporate high yield bonds as the return is attractive with interest rate hovering around 15%. Another sign of risk affinity is investors' poured money into emerging market equities. However, Gold is still in demand, ranking among top 5 in terms of inflow. Biggest outflow is still from developed market equities and short to medium dates treasuries.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed