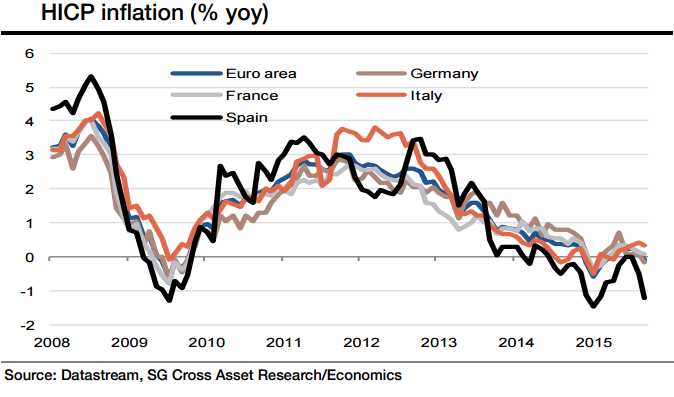

While food prices continue to contribute positively to headline inflation, and core inflation remains stable, oil prices have remained low at around $45-50 per barrel, ensuring that the energy contribution to inflation remains negative. After slowing to 0.8% in 2014 from an average of 1.1% in 2013, core inflation upped the tempo somewhat in 2015, increasing from 0.6% in January to 0.9% in September.

"We maintain that the pace of core inflation is likely to be sluggish and will average 0.8% in 2015 before gradually increasing to 1.2% in 2016", says Societe Generale.

Euro area inflation in September fell into negative territory for the first time since March 2015. In yoy terms, it fell into the red (-0.1%), with the energy component at -8.9% yoy. Prices in Italy slowed to 0.2%, Germany fell into negative territory (-0.2%), while Spain, where inflation was already negative, saw a further significant fall to -1.2%.

"Given the base effects from the sharp decline in oil prices towards the end of 2014, our Brent forecasts of around $50 per barrel by year-end and the estimated depreciation of EUR/USD to 1.05 towards the end of 2015, we expect headline inflation to increase by year-end", added Societe Generale.

The inflation turnaround towards the end of the year is likely to pick up pace in 2016, underpinned by the expected economic recovery, the pass-through of past declines in the euro exchange rate and the assumption of a recovery in oil prices in the year ahead. These factors, alongside higher food prices, should see core inflation converge with headline inflation.

Fuel prices push Euro area headline inflation into negative territory

Wednesday, September 30, 2015 8:23 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022