EUR/USD pared most of its gains due to political uncertainty in France. It hit a low of 1.1640 at the time of writing and is currently trading around 1.17071. Intraday trend remains bullish as long as support 1.1640 holds.

With Prime Minister Sébastien Lecornu quitting just 14 hours, France's political scene is disintegrating in its worst crisis since the beginning of the Fifth Republic in 1958. Following the revealing of his cabinet on October 6, 2025, shattering records for the briefest government tenure in modern history amid threats of no-confidence votes from opposing parties like Marine Le Pen's National Rally, which calls for snap elections, and the far-left France Unbowed, advocating President Emmanuel Macron's ouster. Macron's fifth prime minister in less than two years originates in the hung parliament from the 2024 snap elections that divided the National Assembly into none reaching the 289-seat majority threshold, the left-wing New Popular Front (182 seats), Macron's center-right Ensemble (168 seats), and the far-right National Rally (143 seats) making governance impossible. Driven by France's growing eurozone deficit and unsuccessful budget plans that overthrew predecessors Michel Barnier and François Bayrou, the unrest has set off market panic—plunging stocks, rising borrowing costs, the euro, and bank stocks raise debt concerns in conjunction with a recent Fitch downgrade and forthcoming Moody's assessment. Macron faces bad choices: another failed PM appointment, hazardous snap elections that may help the far-right, or his own resignation, which he rejects despite polls supporting National Rally: globally, this paralysis impedes France's EU leadership, Ukraine support, and NATO commitments, therefore aggravating Western alliance weaknesses amongst increasing far-right distrust of these institutions.

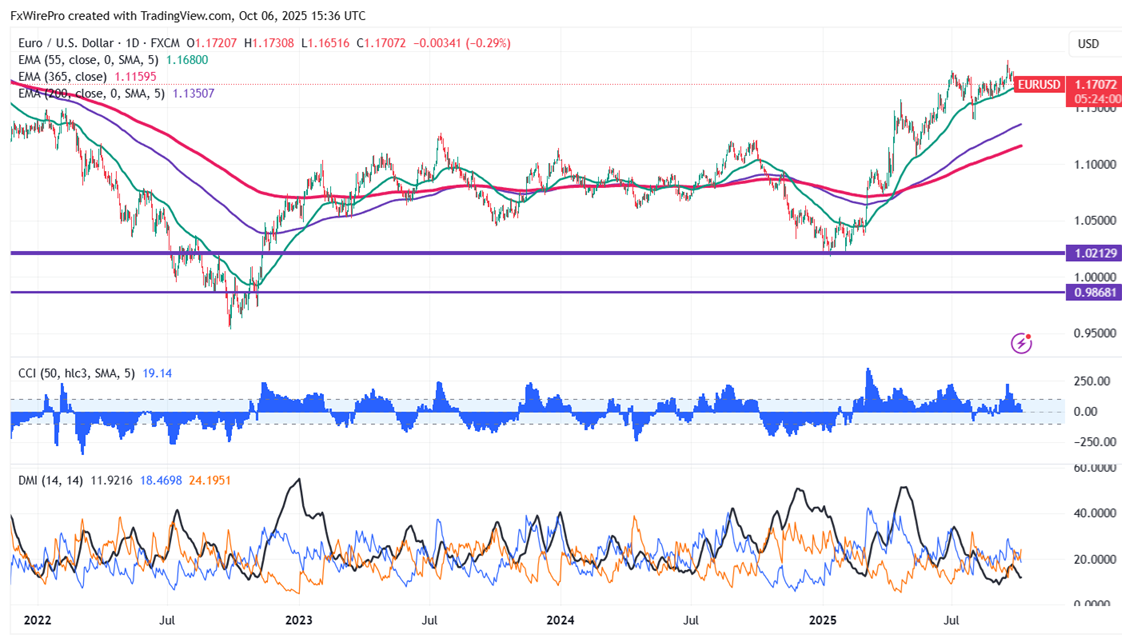

The pair is holding above the 55 EMA, 200 EMA, and 365 EMA in the 4-hour chart. Near-term resistance is seen at 1.17650; a break above this may push the pair to targets of 1.1800/1.1835/1.1850/1.1920. On the downside, support is seen at 1.1640; any violation below will drag the pair to 1.15750/1.1545/1.1480/1.1435.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bullish

Average Directional Movement Index (ADX) - Neutral

It is good to buy on dips around 1.1675 with a stop-loss at 1.1640 for a target price of 1.1835.