Foxconn International, which is known as Hon Hai Precision Industry Co., Ltd. in China and Taiwan, has pulled out from its joint venture deal with Vedanta Limited, a leading natural resources conglomerate in India.

The Taiwanese semiconductor firm withdrew from its $19.5 billion project, and this turn of events was described as a huge blow to Prime Minister Narendra Modi's chip manufacturing plans for his country. According to Reuters, Foxconn did not say why it made this decision despite the fact that it already signed an agreement with Vedanta last year to build a chip and display manufacturing facility in India’s state of Gujarat.

Moreover, it was reported that the country’s prime minister has made chipmaking a top priority as part of his economic strategy for India. He is pushing forward with his plan of making a "new era in electronics manufacturing, but with Foxconn's withdrawal, his ambition of attracting foreign investors for chip production has been shattered. This would have been the very first local chip production in India, but the project has failed.

"Foxconn has determined it will not move forward on the joint venture with Vedanta,” the chip maker said in a statement regarding its pull out from the chipmaking joint venture. “Foxconn is working to remove the Foxconn name from what now is a fully-owned entity of Vedanta."

CNBC reported that Foxconn said its move to drop out was a “mutual agreement” with Vedanta. While it will no longer continue with the JV, it remained confident that India will be able to achieve its semiconductor ambitions.

Foxconn is a known supplier of chips, and Apple is one of its major clients. It is working to further its reach and diversify its supply chains beyond mainland China. It was noted that the company already has several factories across India, but its canceled venture with Vedanta would have been one of its largest projects.

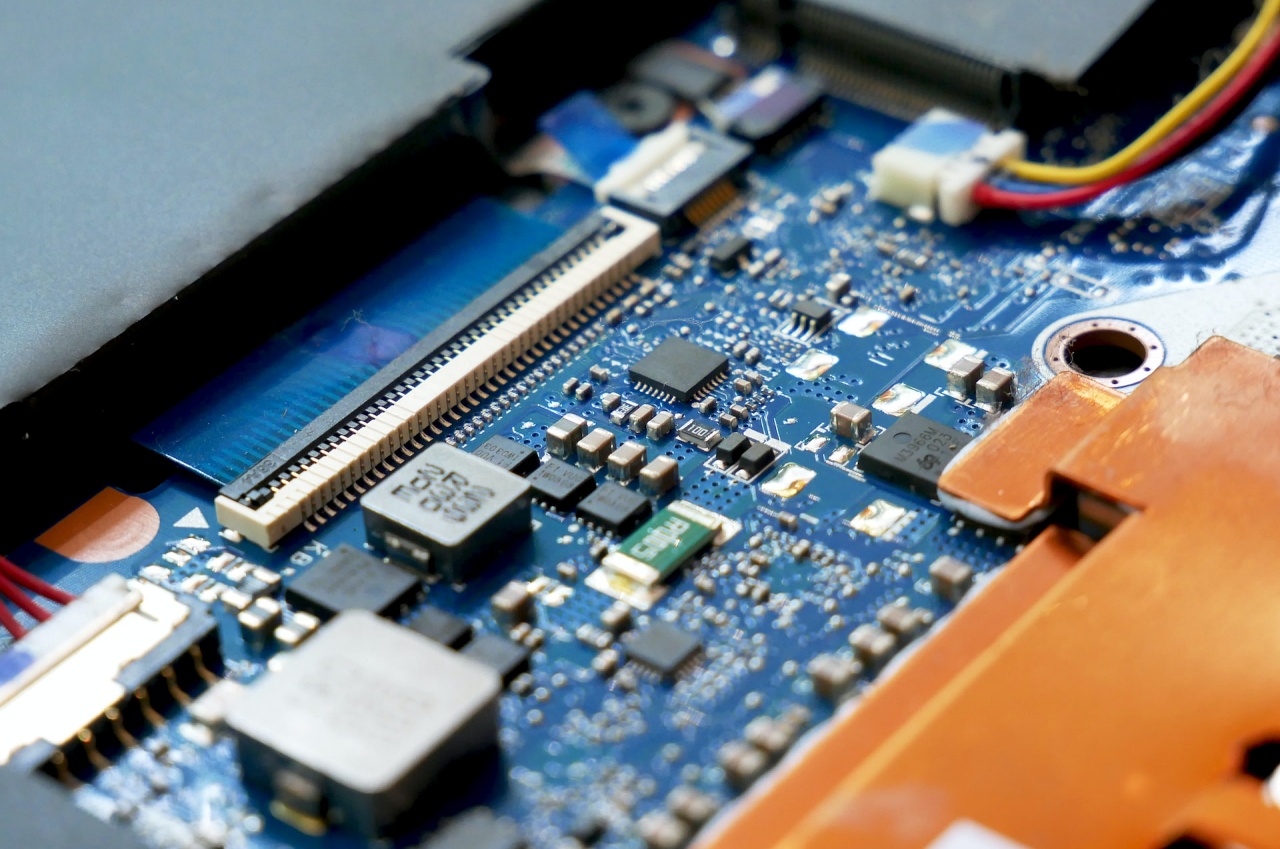

Photo by: Vishnu Mohanan/Unsplash

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users