Earlier this week, US Census Bureau reported the November figure for construction spending and it showed that there was an increase in the month. The U.S. Census Bureau of the Department of Commerce announced that the construction spending during November 2016 was estimated at a seasonally adjusted annual rate of $1,182.1 billion, 0.9 percent above the revised October estimate of $1,171.4 billion. The November figure is 4.1 percent above the November 2015 estimate of $1,135.5 billion. During the first 11 months of this year, construction spending amounted to $1,070.9 billion, 4.4 percent above the $1,025.5 billion for the same period in 2015. Both private and public spending increased in November. In November, the estimated seasonally adjusted annual rate of public construction spending was $289.3 billion, 0.8 percent above the revised October estimate of $287.1 billion.

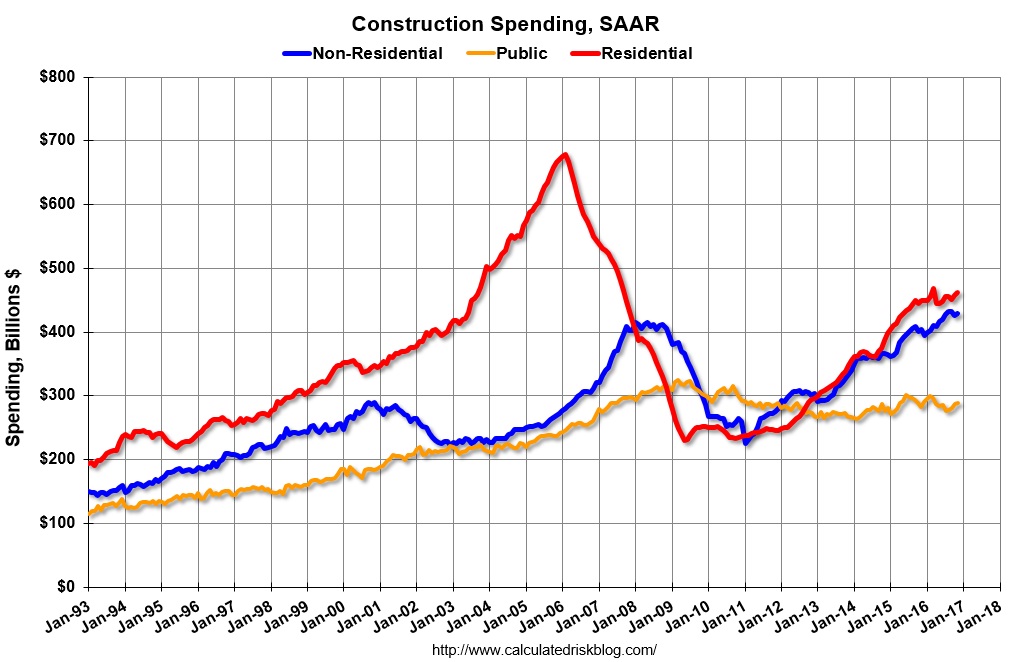

Despite a steady rise in construction spending since 2011, they remain well below the levels seen before the crisis. In 2006, the residential construction spending peaked just below $700 billion (annual rate) and now its stands just around $450 billion. Public construction spending peaked in 2009 above $300 billion but since then it has declined and remains stagnant. The newly elected President of the United States, Donald Trump has promised to ramp up the infrastructure spending and evidence of that would be found in the public construction spending component.

Chart courtesy – calculatedriskblog.com

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off