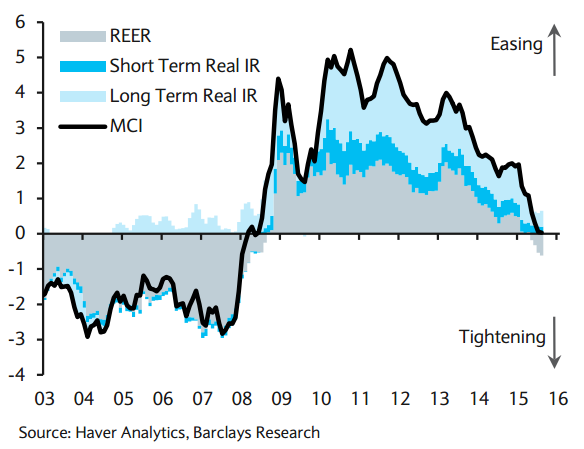

Risks to Britain's financial stability have risen over the past three months, driven by developments in China and other emerging markets. The combination of low inflation, the consequent rise in real interest rates and GBP appreciation have led to a considerable tightening of UK financial conditions over the past year. MPC members have repeatedly expressed concerns about the disinflationary effects of the more than 20% REER appreciation since March 2013.

U.K. government plans to accelerate the pace of consolidation of fiscal deficit through substantial cuts in welfare spending. Despite relatively robust conomic growth, the fiscal contraction of 3.4pp of GDP that is expected over the next three years would be a strong headwind in an environment of surprisingly low inflation. Underneath the headline figures, living standards in UK are still weak. The economy remains unbalanced, manufacturing is under pressure, despite repeated attempts to pep up the sector.

Against this backdrop, markets have pushed back expectations for a BoE rate rise to the tail end of next year, due to emerging market risks and a delay in the U.S. Federal Reserve raising rates. BoE is expected to follow the Fed with a rise in interest rates from their current historic lows. But with UK inflation stuck at zero, the BoE is in no hurry, and investors do not expect a hike until the second half of 2016.

"We think that UK rates will soon begin to move higher and look for two triggers in (Q4): headline CPI to move away from the 0 percent level and ... external (BoE) MPC members to follow-up their hawkish statements by voting for a rate hike," wrote ING strategists in a note to their clients.

While the GBP has roughly kept pace with the USD this year and it is expected to outperform the EUR due to a significant growth differential, headwinds may finally begin to take a toll on cable over the coming year. Risks from the impending referendum on the UK's EU membership also are likely to weigh on sterling at a time when the UK's more than 6% of GDP current account deficit is increasingly reliant on portfolio inflows.

"The superior UK growth prospects to lead to continued sterling appreciation versus the euro, particularly as the ECB extends its asset purchase programme beyond September 2016 in the coming months. However, we expect GBP/USD to trend lower with EUR/USD, as increasing risks are separating the GBP from the USD's more positive fundamentals", says Barclays in a report.

Sterling edged down against a stronger dollar on Friday and faced its worst week against the greenback in six months after U.S. Federal Reserve Chair Janet Yellen said she expected to raise interest rates later this year. Against the dollar, sterling was 0.1 percent down on the day at $1.5224. Against the euro, sterling gained 0.8 percent to trade at 73.12 pence, having hit a one-month trough of 74.11 pence the previous day.

Fiscal headwinds to weigh on Cable over the coming year

Friday, September 25, 2015 11:06 AM UTC

Editor's Picks

- Market Data

Most Popular

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target