The Fed affirmed its signal that it will be appropriate to lift rates at some this year, but the central bank now expects rates to rise a little slower in 2016 than earlier projected.

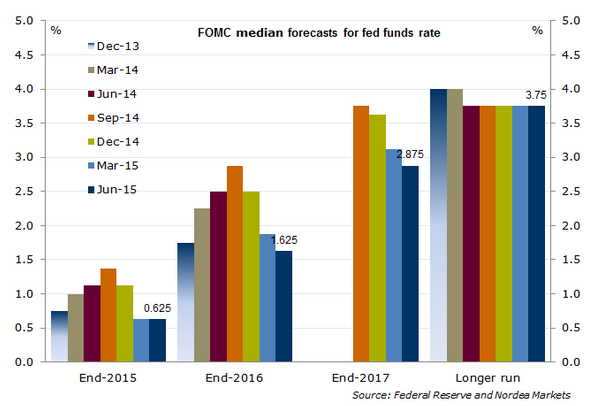

The median FOMC projection for the fed funds rate was unchanged 0.625% by end-2015, consistent with two 25bp rate hikes before the end of the year.

Out of the 17 participants at today's FOMC meeting, 15 believed it will make sense to start raising rates in 2015. The other 2 participants do not expect lift-off until 2016.

However, most other aspects of the dot plot showed a dovish shift, with outlier dots for end-2015 lower compared to March proejctions and with a modest downward revision to the median projections for end-2016 and end-2017.

Five of the 17 FOMC participants today, down from seven at the March meeting, put the midpoint of the fed funds target range at 0.625% by year-end, 50bp higher than today's 0.125%. Five participants, opposed to just one in March, projected only one 25bp rate hike, while five projected three hikes in 2015.

The median FOMC projection for the fed funds rate was lowered by 25bp to 1.625% by end-2016 and by 25bp to 2.875% by end-2017, suggesting a slightly slower pace of tightening in 2016 than projected in March .

With an unchanged 3.75% median estimate of the neutral nominal Fed funds rate, the Fed still doesn't see secular stagnation in the US economy. Markets, on the other hand, are seemingly pricing in a secular stagnation scenario, as suggested by the December fed funds futures contract implying a 1.86% fed funds rate by end-2017, well below 2.875% median FOMC projection by end-2017 and the FOMC's estimate of the long-run neutral fed funds rate.

Nordea notes:

- We continue to expect the first 25bp rate hike in September and see another in December. Despite the Fed's insistence to the contrary, we believe the Fed would prefer to begin the rate-hike cycle at a FOMC meeting that has a scheduled press conference, ie. September and December are preferable relative to July and October.

- We continue to expect the pace of tightening after the initial lift-off in rates to be more rapid than is priced in by markets. More specifically, we believe that rising inflation pressures will prompt markets to price in much faster normalising of Fed policy, potentially triggering a disruptive market shock with adverse spillover to the global economy. History shows that both the markets and the Fed tend to underestimate the eventual pace of rate hikes.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX