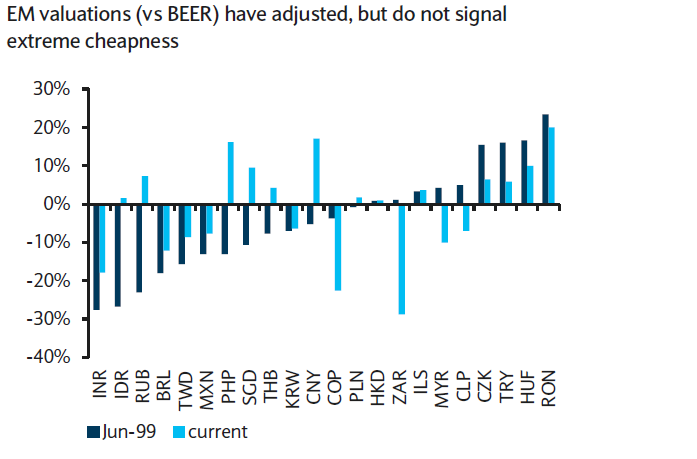

Although some currencies have weakened sharply due to global slowdown especially China, all EM FX do not appear to have overshot. EM Asia FX will face the brunt of slowing Chinese growth and a weaker CNY. Korea and Taiwan are particularly vulnerable given their general openness to trade and their trade exposure to China.

In addition, Korea is actively looking to recycle its current account surplus while having less room to boost economic conditions via policy easing. In Taiwan, exports have been weak recently and could face further pressure from slowing growth in China.

While Elsewhere in EM corporate, we think Hong Kong issuers are likely to benefit from the outflows triggered by a change in China's FX policy. Liquidity and deposits in Hong Kong banks are likely to increase substantially, creating a bid for the bonds they typically buy.

We recommend buying 6 month USDKRW and USDTWD NDFs. We have also initiated a long USDCNH 6m forward recommendation as forwards are not pricing in the extent of weakness in CNY/CNH.

FXWirePro: Korea capitalizing trade surplus despite Chinese slowdown – 6M forwards for hedging

Tuesday, September 29, 2015 1:24 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand