October FOMC meeting is unlikely to deliver any major changes in policy or language. Without a forecast update or press conference scheduled, the focus will be on interpreting any revisions to the statement's language. If the Fed decides to stick with a potential December lift-off, it could signal this by removing the reference to international developments in its assessment of risks. If it decides to move away from the December timeframe, it could insert a phrase that "the pace of job gains has moderated."

At the conclusion of the September FOMC meeting, the Committee expressed great concern that risks surrounding the growth and inflation outlook - then still viewed a 'nearly balanced' - could become more skewed to the downside. Chair Yellen noted that the Committee wanted to see the uncertainty resolved "to some extent" before deciding to lift rates.

Only if the economic data had improved materially versus the Fed's updated expectation outlined in September would warrant a hike next week. Instead, the exact opposite scenario has unfolded, economic data has softened somewhat since the September meeting, arguably adding to policymakers' uncertainty. Q3 GDP growth is now expected to decelerate below its trend rate as weak exports and an inventory correction weigh on the headline and the labour market was dealt a blow from a discouraging September non-farm employment report.

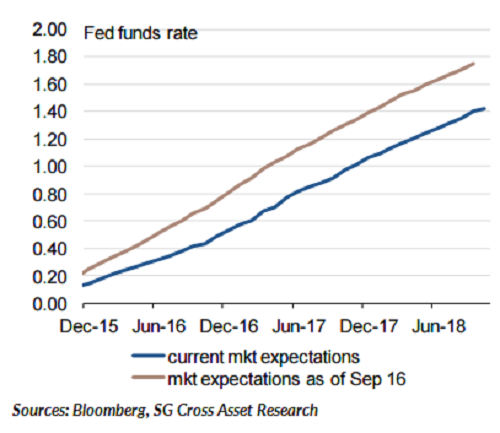

"If the FOMC still intends to hike in December, it will need a lot of help from the data. Our scenario pegs the probability of a 2015 liftoff at only 40%", says Societe Generale in a research note.

Also, the Fed's hands are effectively tied by ultra-dovish rate expectations currently embedded in asset prices. In this scenario, it is extremely unlikely that the FOMC will contemplate a rate hike at the upcoming gathering. More critically, officials will have to decide whether they still consider a December rate hike as likely and, if so, come up with a game plan to prepare the markets. In either case, it is doubtful that the Committee would want to send a strong message at this point, but it could use the post-meeting statement to send subtle hints.

"The FOMC has tried to dissuade markets from expecting any explicit signals about upcoming policy changes, emphasizing data dependence. As such, we anticipate no meaningful changes to the policy guidance language. That should not be read as a sign the Fed will not hike in December; rather that they are keeping all options open. We still see a significant chance that the FOMC will hike this year, but we likely will need to wait for subsequent speeches to get any clarity on the timing of liftoff," notes BofA Merill Lynch in a report.

USD/JPY edged lower from session highs at 121.49 and was trading at 121.03 as at 1040 GMT. EUR/USD was holding above 1.10 handle, trading at 1.1037 after slipping to 1.0989, its lowest since Aug 11 on Friday's trade.

FOMC to prepare for December in October?

Monday, October 26, 2015 11:15 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?