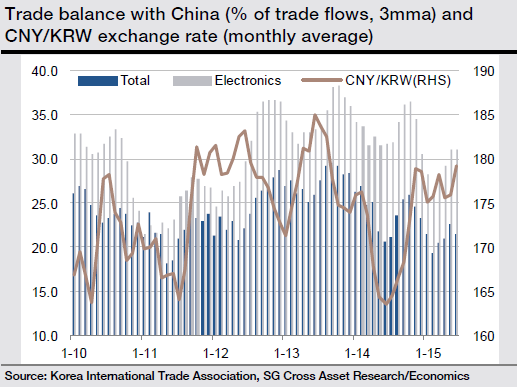

The relationship between CNY/KRW exchange rates and Korea's trade balance with China has not been clear-cut in recent years.

"The rise in trade surplus from 18% of overall trade flows in mid-2011 to 30% in mid-2013 is likely related with the rise of CNY/KRW from 164 to 185. However, the rise in CNY/KRW from 164 to 179 during the past 12 months has not led to any meaningful increase in the trade surplus with China. The fluctuations in the trade surplus are seemed to be driven by the electronics sector, which is pretty natural considering that this sector accounts for 50% of exports and 40% of imports with China", said Societe Generale in a research report on Tuesday.

Recent trade data shows that Korea's exports to China have been supported by the electronics sector since 2012. Nonelectronics exports have been declining since 2014, led by the chemical and machinery sectors. This supports the argument that the Chinese economy is experiencing a hard landing in its 'old' economy (the industrial and construction sectors).

Societe Generale anticipates the following developments to prevail in trading between two countries:

- 1) potential fluctuations in CNY/KRW will not significantly affect Korea's trade with China

- 2) the further deterioration of China's growth momentum may not affect Korea's exports, as a Chinese 'hard-landing' has already been reflected in the recent trade pattern

- 3) the outlook for Korea's exports to China may rather be determined by the outlook for an electronics industry that is somewhat more relevant to the conditions of developed economies.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX