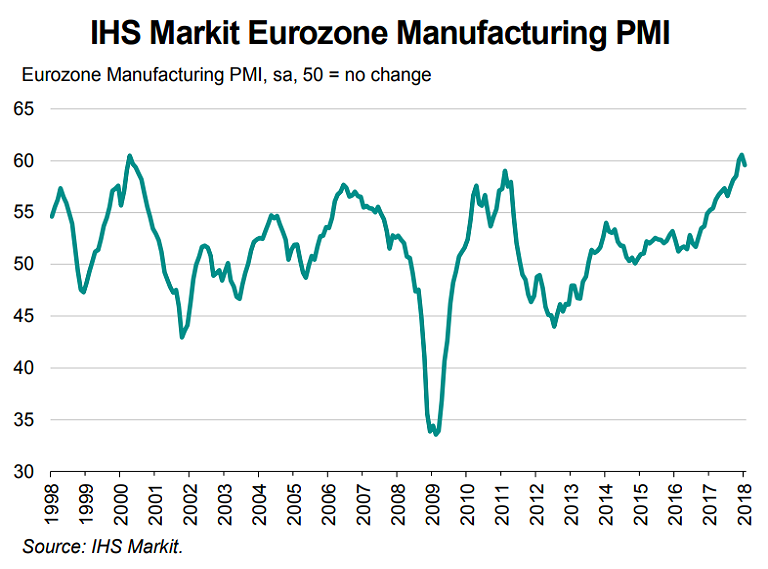

Eurozone’s manufacturing sector made a strong start to 2018. IHS Markit’s January final manufacturing Purchasing Managers’ Index for the euro zone was confirmed at 59.6, matching an earlier preliminary reading. PMI readings, though down to a 3-month low, remained close to record highs in January. PMI readings remained close to record highs in Germany, Austria and Ireland, and among the best for 17 and ten years in France and Spain respectively. Data showed that the bloc’s economic recovery still has momentum.

Details of the report signaled solid growth across the consumer, intermediate and investment goods categories. Continued strong expansions of both production and new orders boosted business confidence. Confidence improved in all nations bar Germany and Austria. Euro area manufacturing employment rose for the forty-first successive month in January as firms expanded capacity in line with rising demand.

Inflationary pressures picked up at the start of 2018, with both output charges and input prices rising at faster rates. Output price inflation accelerated to an 80-month high. A steep rise in oil prices during the month resulted in a further intensification of cost pressures. Shortages for some inputs as demand outstripped supply led to one of the sharpest lengthening of supplier lead times on record.

"With higher costs being increasingly passed on to customers, the survey sends a warning signal for a potential rise in future consumer price inflation,” said Chris Williamson, Chief Business Economist at IHS Markit.

The European Central Bank (ECB) last week held policy unchanged and withheld discussing winding-down its massive stimulus program, as inflation has yet to show any convincing upward trend. ECB policymakers have struggled for years to get inflation anywhere near their 2 percent target ceiling. Today's data will be welcomed by the ECB as it moves to unwind its super-loose monetary policy.

Euro extended gains against the dollar. EUR/USD was up 0.20% on the day, at 1.2437 at around 1050 GMT. Near-term bias remains bullish. 20-DMA at 1.2234 is strong support, break below could see minor weakness. EUR/JPY was up 0.62% at the time of writing, trading around 136.37 levels.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility