The euro-zone’s services sector has held up relatively well so far this year. However, we expect spill-overs from the industrial recession and slowing employment growth to take a toll in the coming months. The latest business surveys point to a sharp deceleration in the sector in Q4, according to the latest research report from Capital Economics.

In recent months, many commentators have taken comfort from the fact that, while the euro-zone’s industrial sector is in a deep recession, services are holding up better. Admittedly, it has not been immune to the industrial downturn: services output growth slowed from 2.4 percent in 2017 to 1.6 percent y/y since late 2018, with the weakness concentrated in areas most exposed to manufacturing. But the services sector has not slowed any further over the course of 2019.

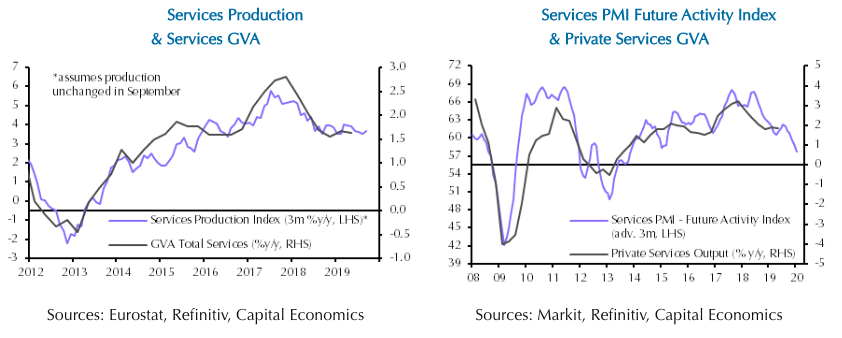

The latest data suggest that services have maintained their pace in the third quarter. There is yet no breakdown of third-quarter GDP for the euro-zone as a whole, but monthly production data for services are available up to August.

These are not identical to the national accounts data because they exclude “finance and insurance”, “arts, entertainment and recreation” and “public administration, health and education”. But they are quite closely correlated with the quarterly data.

The year-on-year change in this index points to annual services output growth remaining around 1.6 percent in Q3. This is broadly consistent with the message from the latest national GDP data, which showed services output growth was unchanged in France and slightly slower in Spain, the report added.

Not surprisingly, the sectors most exposed to industry have continued to struggle the most. In August and September, activity in “professional, scientific and technical activities” slowed sharply while “transportation and storage services” growth softened.

But information and communications services, which is less exposed to industry, slowed too, perhaps indicating that the weakness is spreading.

Looking ahead, the latest business surveys point to a steeper downturn to come. The services PMI has dropped from 58.0 in January 2018 to 52.2 in October this year, and the ESI has also declined. In the PMI surveys, firms have cited domestic and global political uncertainty, and spill-overs from manufacturing, as weighing on activity. Slower employment growth is also playing a part.

The euro-zone services PMI’s future activity index, which measures whether businesses expect their output in a year’s time to be higher, the same or lower than currently, is close to a five-year low. On past form, it points to euro-zone private services output growth slowing sharply in the coming months. This is also true for three of the euro-zone’s four largest economies.

"The upshot is that the outlook for the euro-zone’s services sector is weakening. With industry likely to remain in recession next year, we think that annual GDP growth will slow to only around 0.5 percent," Capital Economics further commented in the report.

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns