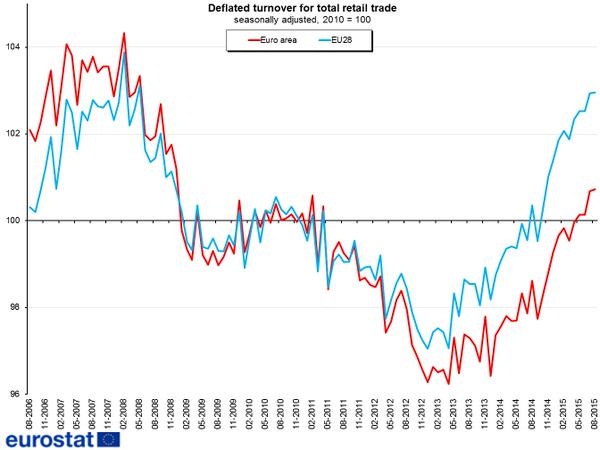

Euro zone consumers are living up to the theory that reformed European Monetary Union has one of the best growth dynamics in the world as of now. While weaker Euro is working its magic for exporters making their products cheap globally, domestic focused companies are also warming up to rising consumer confidence and rise in spending.

- Retail sales index, is up 2.3% in August compared to a year ago.

- In Euro area, sale of Automotive fuel is set to rise 1.8% compared to July and 0.8% for food, drinks and tobacco but non-foods dropped by 0.3%

- Highest growth in retail trade (m/m) was registered in Portugal (+1.5%), followed by Ireland (+0.9%).

Going ahead, Euro might benefit from better than expected economic dockets as they will tend to diminish further quantitative easing hopes from European Central Bank. Inflation remains key for further expectations as of now.

One thing can be said with some degree of certainty, further easing or nor, inflation or deflation, Euro zone is likely to see better days ahead in terms of growth.

Euro is currently trading at 1.127 against Dollar.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand