Greek Prime Minister Alexis Tsipras has promised voters he’ll reject even one euro cent more of budget austerity than is needed under the country’s bailout.

Their international creditors say the program’s requirements may include 3.5 billion euros ($3.9 billion) in extra fiscal tightening he hadn’t bargained for.

The demand by the euro area and the International Monetary Fund is a potential bombshell for their government amid raising the threat of renewed instability in Greece.

The prime minister’s current dilemma stems from a disagreement between the euro area and the IMF.

While the European creditors say the government in Athens has committed to enough austerity to reach the targeted budget surplus before interest payments of 3.5% of gross domestic product in 2018, the IMF projects current Greek measures will produce an excess of just 1.5%.

Elsewhere, Brexit on the corner not only causing pressure on UK but also Euro dealings,

Brexit' Risks Leaving European Banks With $123 Billion to Cover

Lenders may have to dump some securities if Britain leaves EU

Bonds may no longer meet liquidity requirements under Basel

The close encounter is on the cards in 2016 for EUR/GBP as the pair is more one of valuation, which is tricky to judge, we remain bears of GBP/USD as well as in EUR/USD, the ’Sword of Brexit’ is hanging over confidence, and EUR/GBP valuations go hard-pressed.

We look ahead to foresee cable to drop below 1.40 by Q3 2016 and we see EUR/GBP struggling to break below 0.70, even as EUR/USD falls.

EURJPY OTC observations:

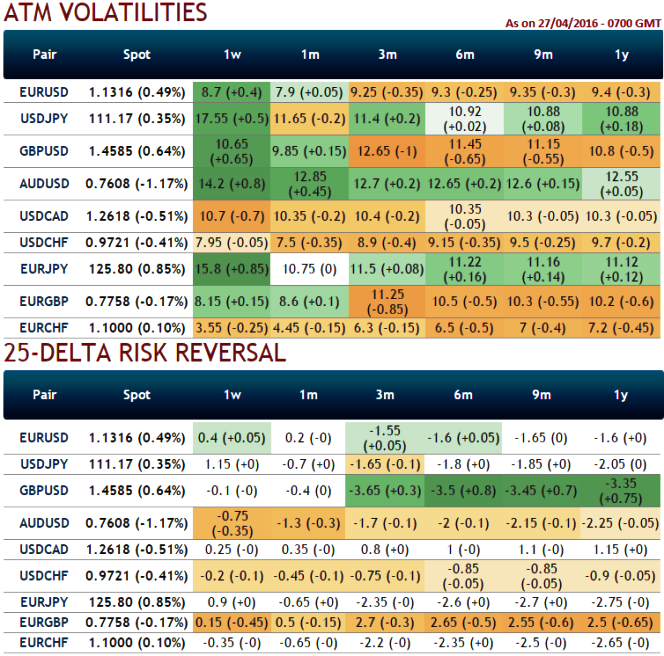

We’ve been stating the delta risk reversals increasing up progressively with negative numbers, EUR/JPY still carries more downside risks are still in long run as delta risk reversal suggested puts have been overpriced then use OTM puts that are available in cheaper premiums comparatively.

So, what exactly we could benefit from these numbers is that –

If a foreign trader is willing to assume some risk in return for the chance to exchange currency upon maturity at a better rate than the current forex forward rate.

If he wants to block in a worse circumstance but still acceptable exchange rate just in case the exchange rate develops differently than projected by the customer.

So, the reiteration is that OTC set up signifies the hedging sentiments are well equipped for extreme downside risks in long run.

Contemplating above OTC market’s indications, the implied volatility of ATM contracts of this pair is at around 15.8% for 1W expiries and 10.75% for 1M tenors which is the second highest among G10 currency space, we eye on loading up with fresh longs for long term hedging, more number of longs comprising ATM instruments and ITM shorts in short term would optimise the strategy.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed