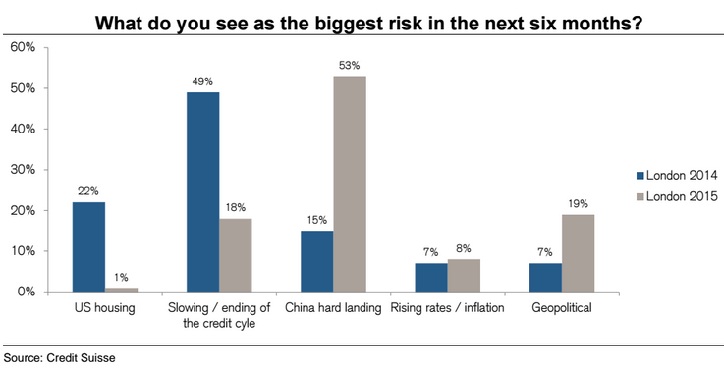

A survey by Credit Suisse show that European investors are clearly more worried on China than anything else for the matter.

Similar survey by Barclays, published earlier this month showed fund managers are most worried on China as many are expecting recession next year.

Slowdown in China has already started hitting the emerging economies hard leading to massive slide in some currencies and commodity market, which is likely to lead to lot many bankruptcies.

Commodity giant Glencore's share price has touched new all-time low, sliding as much as 25% today alone. Credit default swap spread has risen to new all-time high of 708 basis points, according to data provider Markit.

According to the survey (expectations over next six months),

- 53% of the investors are most worried on hard landing in China compared to 15% in 2014.

- Only 18% of the investors are most worried on ending of credit cycle, compared to 49% in 2014.

- 19% of the investors worried on geo-political risks compared to just 7% in 2014.

- Inflation remains less of a concern with only 8% worrying over it.

- Concern over US housing has declined from 22% in 2014 to just 1% in 2015.

Chart courtesy Soberlook.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand