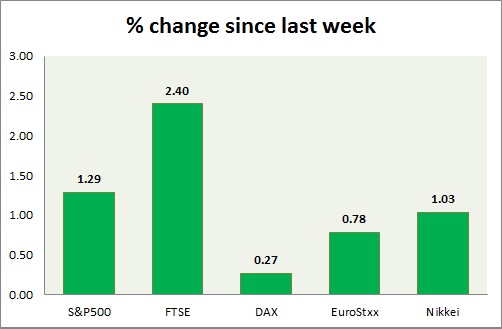

Equities are marginally higher today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P is marginally up today, as lower rise in employment cost causing some headwinds. Today's range 2116-2104.

- US employment cost index rose by +0.2%, lowest since 1982.

- Chicago PMI rose by 54.7 in July.

- Michigan consumer sentiment dropped to 93.1 in June from 93.3 prior.

- S&P 500 is currently trading at 2112. Immediate support lies at 1980, 2040 and resistance 2150.

FTSE -

- FTSE top performer this week as economic outlook improved along with company results. Today's range 6710-6650.

- FTSE is currently trading at 6700. Immediate support lies at, 6050, 6450 and resistance at 6850, 7000.

DAX -

- DAX is marginally higher today. Today's range 11320-11170.

- DAX is currently trading at 11320. Immediate support lies at, 10500-10600 area and resistance at 11800 around.

EuroStxx50 -

- Stocks across Europe are all mixed today.

- Germany is up (+0.46%), France's CAC40 is up (+0.70%), Italy's FTSE MIB is up (+0.60%), Portugal's PSI 20 is down (-0.60%), Spain's IBEX is up (+0.20%)

- EuroStxx50 is currently trading at 3605, up by +0.45% today. Support lies at 3300 and resistance at 3760.

Nikkei -

- Nikkei is higher as Yen weakened across board.

- Outlook for Japanese companies improved as construction orders rose by 15.4% in June from a year ago. Housing starts rose by 16.3%

- Nikkei is currently trading at 20570, with support around 20000 and resistance at 21000.

|

S&P500 |

+1.29% |

|

FTSE |

+2.40% |

|

DAX |

+0.27% |

|

EuroStxx50 |

+0.78% |

|

Nikkei |

+1.03% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand