Uncertainty over US Federal Reserve rate hike making the investors nervous, who are choosing to push money out of US markets this year. Several fund managers are underweight US equities this year, while those are overweight, are only by 4-6% compared to 25% last year.

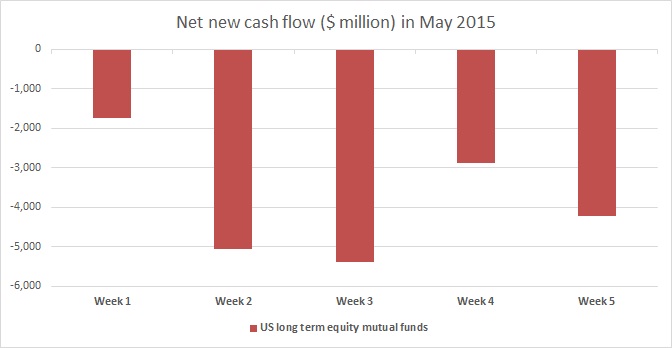

The chart above shows, as Federal Reserve meeting approaches in June 17th, money is flowing out at record pace, not seen since European debt crisis panic in 2011/12.

- Latest data from ICI, a market intelligence group that track flow of money shows that after pulling out more than $28 billion in March and April, investors pulled out more than $19 billion from US long term mutual funds.

Some fundamental analysts point out that valuation is quite stretched and market might be ripe for larger correction.

- Though overall median PE ratio remains well below of 2008/09 period, cyclically adjusted PE ratio (CAPE) has reached highest level seen during 2008/09 stock market high. CAPE is considered as a fundamental measure, even used by central banks. High CAPE ratio are often associated with stock market bust.

S&P500 is currently trading at 2107, up by just 1.6% so far this year. Currently it is trading in small range of 2040-2130.

It is strongly advisable to book partial profit and wait for larger correction to avoid uncertainty of FED rate hike.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand