As investors ask the critical question, "where might the next crisis come from?" The answer is usually the same "Emerging markets and China".

Why is that so? Is it because commodities are down or US dollar is stronger than their currencies?

The answer is obviously mixed bag of that and the fact that since the financial crisis of 2008/09 developed market economies have kept their banks and corporations under heavy scrutiny, whereas emerging market watchdogs have completely failed to do so.

In absence of yield in developed markets, investors have poured trillions of Dollars into emerging economies, which these countries and their corporation gobbled up.

To benefit from low interest rate environment emerging market corporates have issued more debt they can actually digest, which came back to haunt them as growth failed to show up as expected.

US Federal Reserve's $ 4 trillion quantitative easing led to this massive inflow of money into emerging market corporate sector, which has started reversing its course.

Though reversal has begun slowly back in 2011, intensified in 2013 and moved to higher gear this year. In August estimated $150 billion has left Chinese economy.

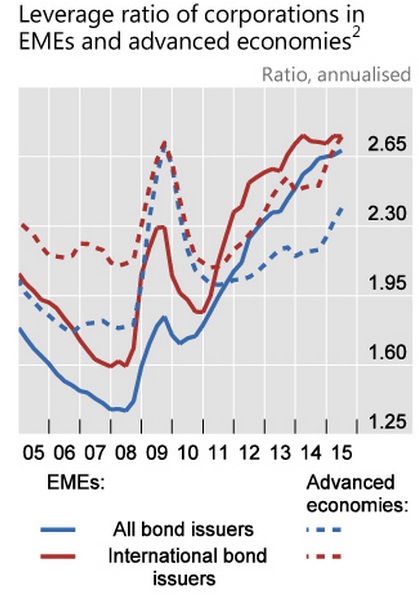

As shown in the chart from Bank of International Settlements (BIS), central banker of central banks corporate leverage (calculated by debt/ebitda) in emerging markets jumped from around 1.3 back in 2008 to 2.65 heading into 2015.

Deleveraging among corporates is still not significant enough compared to their earnings potential.

It can be said with some degree of certainty that the storm ravaging emerging markets unlikely to abate soon.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand