According to latest European Central Bank's (ECB) forecast in financial stability report, emerging market slowdown is likely to persist next year.

BTG's incident from Brazil is a nice example, where the Bank's CEO has been arrested over his links to Petrobras scandal. Andre Esteves, Brazilian billionaire, credited to transforming BTG into Latin America's largest investment bank. You can check out the story at http://www.bloomberg.com/news/articles/2015-11-25/btg-s-andre-esteves-senator-amaral-arrested-brazil-police-say

It shows, how vulnerable emerging market and companies are not just only to slow down or commodities' decline but also to corruption scandal at large. To remind you, Malaysian Prime Minister facing similar situation over 1MDB.

While some emerging markets have greater exposure to commodities and energy (Malaysia, Indonesia, Peru, Chile, Brazil etc.), some has heavy exposure to China (Singapore, Taiwan, South Korea ect.) and these macro themes (lower oil, slower China) responsible for their weakness are likely to continue, hence the weakness too).

These weakness, even if recovers from here likely to make a dent in advanced economies and hence the spiral of weakness back again.

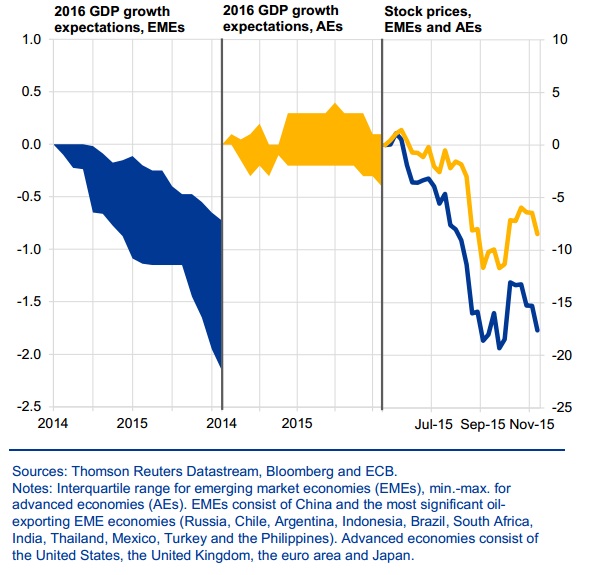

European Central Bank (ECB) is considering emerging market weakness to be Europe's top vulnerability and according to ECB forecast, emerging markets' GDP on an average to shrank more than 2% in worst case scenario and -0.7% under best case.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary