This year emerging market has been ravaged by outflow of money which has pushed currencies of many countries, such as Brazil, Indonesia, South Africa, Chile, and India to multi-year low against Dollar.

- While currencies have depreciated a lot, investors have taken money out of emerging market equities. Data from EPFR, a global fund flow statistics provider, shows investors have pulled out billions of Dollars from emerging market equity funds for ninth consecutive week, making outflow (net flow) of $58.2 billion so far this year.

- Chinese market equity turmoil is undoubtedly an out layer scenario, with index losing 40% of its value since June, indices are down, all across emerging markets. Indian equities, which was initially up for the year is now down close to 5%.

All have happened in anticipation of rate hike from US Federal Reserve. Naturally many analysts fear that situation might get uglier when FED actually hike rates.

Despite the crisis, Emerging market debts have performed relatively well, and fear is rising it might start crumbling with rise in US interest rates.

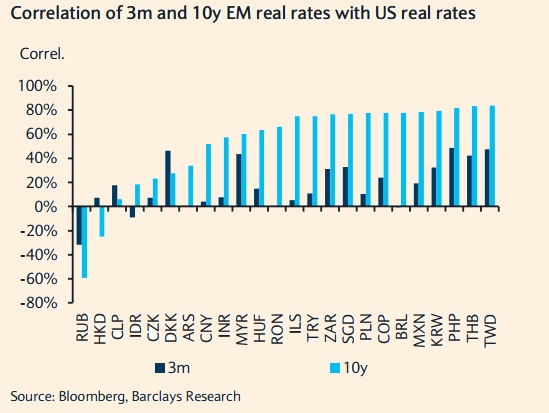

Charts from Barclays Research, courtesy of Financial Times, show that emerging markets real rates are likely to rise with rise in US real rates and FED's move might just do that.

- Emerging economies such as Taiwan, Thailand, Mexico, Brazil etc. all have very high correlation with US real rates, especially in the longer end of the curve (above 60%). It would strain emerging market corporates who are already burdened with excessive debt.

- Shorter end shock could be more discreet as some economies have high correlation with shorter end curve. Countries like Malaysia, South Africa, Singapore, Philippines, Taiwan, Thailand, turkey have relatively higher sensitivity to shorter end rise making them extra vulnerable.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings