EURGBP pared some of its gains after the BOE's monetary policy. Intraday bias remains bearish as long as support 0.8750 holds. It hits an intraday low of 0.86798 and is currently trading around 0.86845.

Reducing the Bank Rate by 25 basis points to 4.00%, the Monetary Policy Committee of the Bank of England today marked the fifth straight reduction since August 2024. Although a 0-5-4 split vote showed internal conflicts (with no members favoring a hold and four pressing for a bigger cut), the MPC kept its "gradual and cautious" approach to easing. With forecasts updated and forward guidance anticipated to clarify the Bank's continuing approach to balance price stability with economic expansion, this decision follows persistent inflation over the 2% target and growing indications of economic stagnation.

Technical Analysis

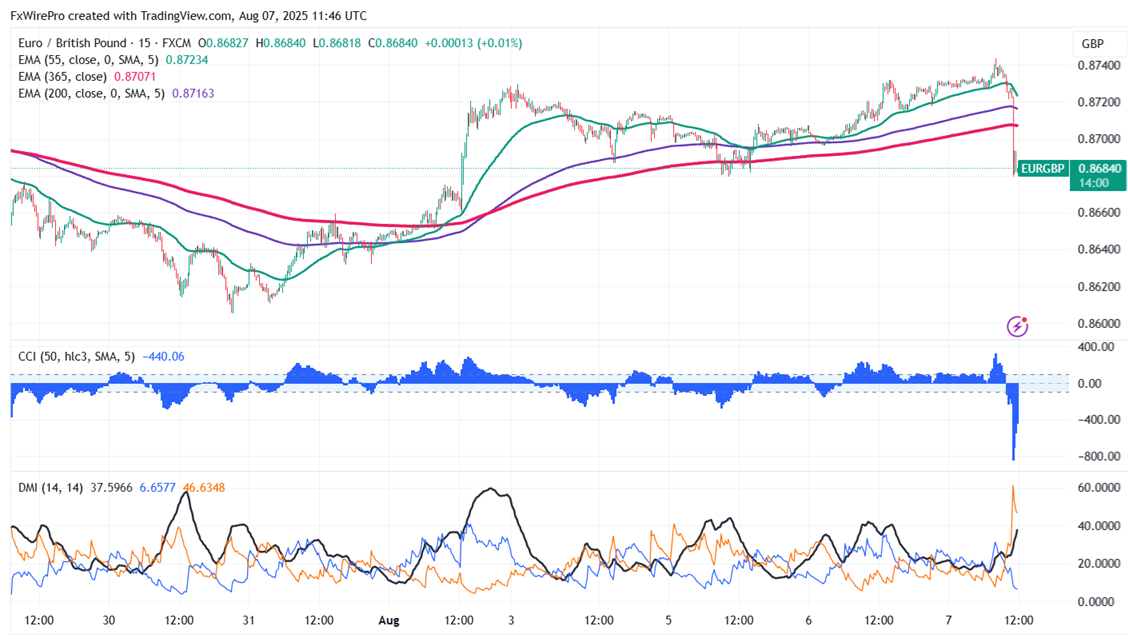

The pair is currently trading below above 55 and 200-EMA and 365-EMA on the 15-min chart.

Bearish Trend Confirmation: Any break below 0.8675 confirms an intraday bearish trend. A drop to 0.8630/0.8600/0.8560/0.8520/0.8480 is likely. Near-term support is around 0.8630.

Near-Term Resistance: The near-term resistance is around 0.8750. Any violation above will take the pair to 0.8800/0.8850.

Indicator Analysis (15-min chart)

CCI (50): Bearish

Average Directional Movement Index: Bearish

Trading Recommendation

It is good to sell on rallies around 0.8700 with SL around 0.8750 for a TP of 0.8600.