The EUR/USD currency pair remained on the firmer side of trading during the mid-European session Tuesday, guided by an upbeat reading of German as well as Eurozone’s manufacturing PMIs for the month of December.

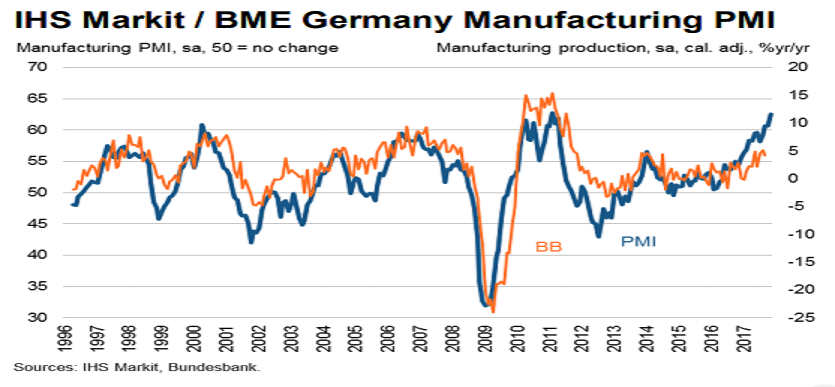

The headline Final IHS Markit/BME Germany manufacturing PMI climbed to an all-time high of 63.3 in December from 62.5 in November, surpassing the previous highest reading recorded in February 2011.

Expansion in the German manufacturing sector was also reflected in a further rise in the level of employment, as goods producers sought to improve capacity amid a near-record increase in backlogs of work. Although the pace of job creation eased slightly from November’s 80-month high, it still pointed to a marked overall rise in factory workforce numbers.

Further, strong rates of expansion in output, new orders and employment pushed the final IHS Markit Eurozone manufacturing PMI to 60.6 in December, its best level since the survey began in mid-1997. The PMI was up from 60.1 in November and identical to the earlier flash estimate.

The expansion was led by the investment goods sector, where the pace of growth signaled by the PMI was also a record high. The rate of improvement in the intermediate goods sector remained close to November’s survey-record. Growth was slower in the consumer goods sector by comparison but remained solid and well above its long-run trend.

Meanwhile, following the above-neutral PMI readings, the EUR/USD currency pair continued to hover at around 2-year high, rising 0.37 percent to 1.2050 by 09:15GMT.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals