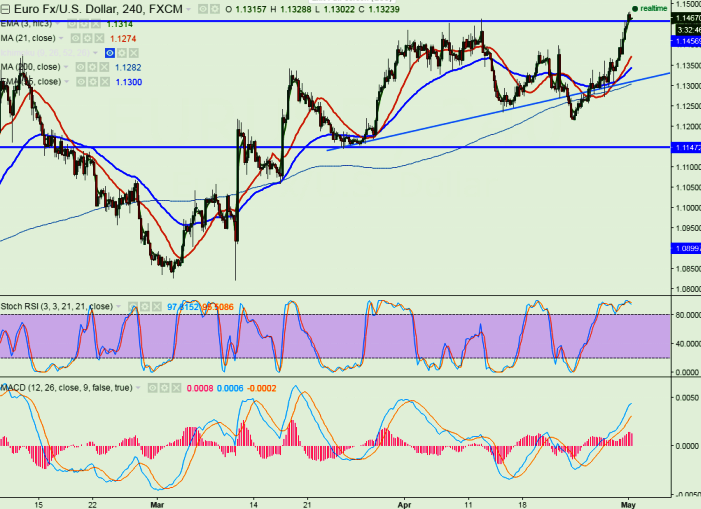

- Major resistance- 1.14650 (Apr 12th 2016)

- Major Support – 1.1370

- Euro has broken major resistance 1.14650 and jumped till 1.14811 at the time writing. It is currently trading around 1.14670.

- Short term trend is slightly bullish as long as support 1.1370 holds.

- On the lower side any break below 1.1370 will drag the pair down till 1.1335/1.1300.

- Any break above 1.1465 confirms major trend reversal, a jump till 1.1500/1.1545/1.1600 is possible.

- Short term weakness only below 1.1270 (low formed after Fed meeting).

It is good to buy at dips around 1.1435-1.14400 with SL around 1.1370 for the TP of 1.1545/1.1600

R1-1.1500

R2-1.1545

R3-1.1600

Support

S1-1.1370

S2-1.13300

S3-1.1270