EUR/USD gained after weak US jobs data. It hit an intraday low of 1.16299 and is currently trading around 1.16511. Overall trend remains bullish as long as support 1.1575 holds.

The ADP National Employment Report indicated a small 54,000 private sector jobs added in August 2025, implying that the U.S. labor market was cooling. Well below the anticipated 100,000 and down from July's change of 104,000, service sectors such as leisure and hospitality (+50,000) were propelling increases, while trade, transportation, and utilities saw Losses in education and health services (-12,000) and in (-17,000). Led by construction (+16,000), goods-producing industries added 13,000 positions; by company size, medium-sized businesses contributed the most jobs (+25,000). For the week ending August 30, first jobless claims also increased to 237,000, above estimates and achieving the highest level since June, with the four-week Moving average reaching 228,500 indicated continuing labor market stress despite a little decrease in continuing claims to 1,954,000.

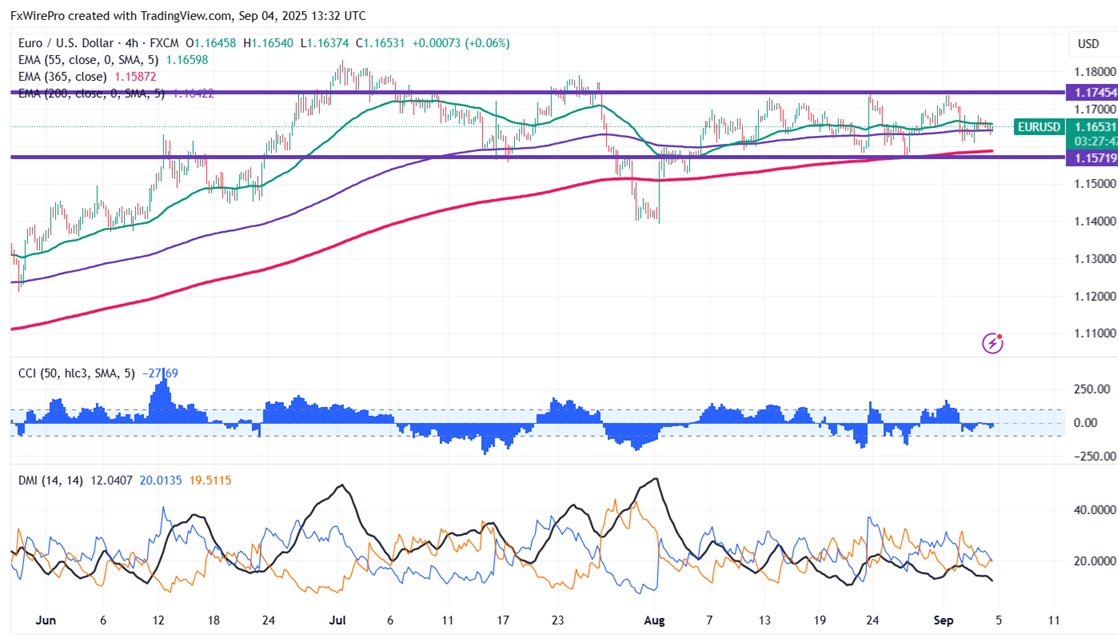

The pair is holding below the 55 EMA, 200 EMA, and 365 EMA in the 1-hour chart. Near-term resistance is seen at 1.1665, a break above this may push the pair to targets of 1.1700/1.1765/1.1800/1.1835/1.1900. On the downside, support is seen at 1.1620; any violation below will drag the pair to 1.15750/1.1545/1.1480/1.1435.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bearish

Average Directional Movement Index (ADX) - Bearish

It is good to buy on dips around 1.16000 with a stop-loss at 1.1545 for a target price of 1.1765.