EURJPY trades flat ahead of the ECB monetary policy. It hit a low of 171.37 yesterday and is currently trading at approximately 172.20. Intraday outlook remains bullish as long as support 171.35 holds. Short-term outlook remains bullish as long as support 167.60 holds.

Technical Analysis:

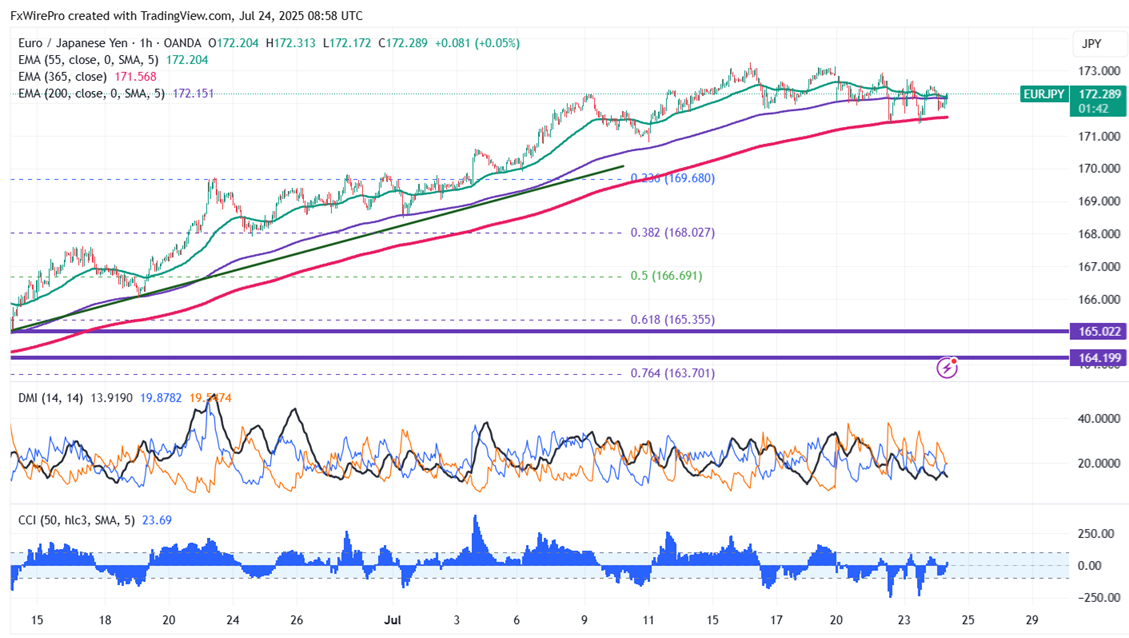

The EUR/JPY pair is trading above 55 EMA, above 200 and 365-H EMA on the 1-hour chart.

- Near-Term Resistance: Around 172.50, a breakout here could lead to targets at 172.96/173.25/174.

- Immediate Support: At 171.80 if breached, the pair could fall to 171.35/170.80/170/169.60/169/168.70/168.45/168/167.60 166.50/ 165.95/165.55/164.50/164.

Indicator Analysis 1-hour chart):

- CCI (50): Neutral

- Average Directional Movement Index: Neutral

Overall, the indicators suggest a mixed trend

Trading Recommendation:

It is good to buy on dips around 171.50-55 with a stop loss at 170.80 for a TP of 173.25/174.