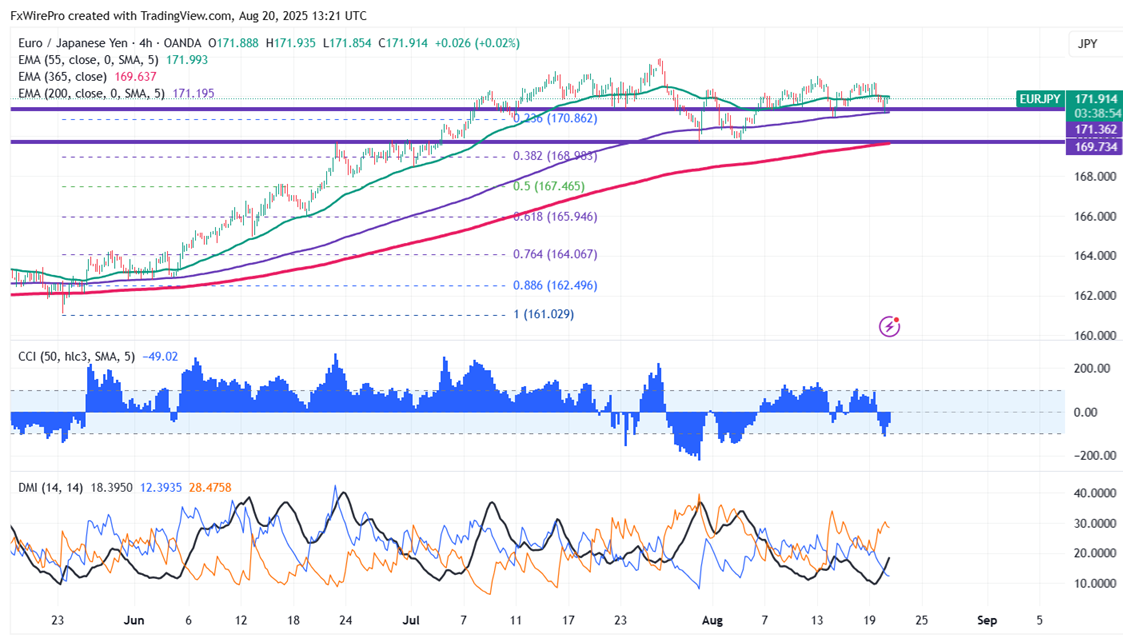

EURJPY took support near 200- 4H EMA for the second consecutive time and showed a minor pullback. It hits an intraday high of 172.62 and is currently trading at approximately 172.39. Intraday outlook remains bullish as long as support 169.75 holds.

Technical Analysis:

The EUR/JPY pair is trading below 55 EMA, above 200 and 365-H EMA on the 1-hour chart.

- Near-Term Resistance: Around 172.25, a breakout here could lead to targets at 173/173.89/174/175.

- Immediate Support: At 171.10 if breached, the pair could fall to 170.80/169.70/169/168.70/168.45/168.

Indicator Analysis 4-hour chart): - CCI (50): Bearish

- Average Directional Movement Index: Neutral

Overall, the indicators suggest a mixed trend

Trading Recommendation:

It is good to buy on dips around 171.80 with a stop loss at 171 for a TP of 174.

Z