ETH/USD traded weak on Thursday, falling to $12.21 levels. It currently trades slightly up at $12.37 levels (Kraken) at the time of writing.

The pair saw a massive drop on Tuesday, where it fell from $14.10 levels to $11.33 levels. Experts believe that the price drop was driven by recent reports that pointed out new vulnerability that may prevent Ethereum soft fork.

“$ETH price drops 11% on news of Vulnerability in the Soft Fork Release”, Tuur Demeester, Editor in Chief at Adamant Research, said in a tweet.

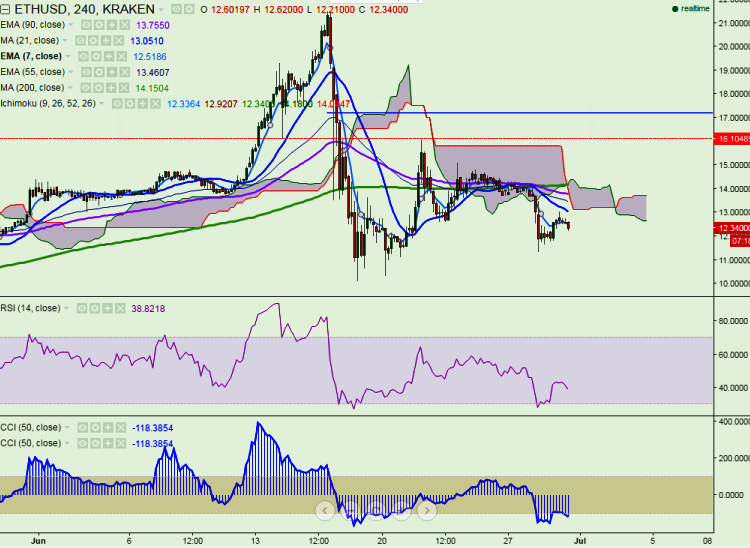

Ichimoku analysis (4 Hour chart):

Tenkan-Sen level: $12.33

Kijun-Sen level: $12.92

Trend reversal level - (90 4H EMA)-$13.96

Long-term trend is bullish and the pair faces major resistance at $12.57 (7 4H EMA) and any break above that level will take the pair till $13.12 (21 4H MA)/ $13.78 (90 4H MA). On the reverse side, short-term support is seen at $11.33 (Jun 28 th low) and any violation below will drag the pair till $10.

“The pair has recovered slightly after making a low of $11.33. ETH/USD has jumped till $13.02 and but struggling to closer above 21 4H MA. So any bullishness only above that level”, FxWirePro said in a statement. “In 4 hour chart ETH/USD is trading well below Tenkan-Sen and Kijun-Sen. So, dip till $10 is possible.”

ETH/USD outlook weak in short-term, dip till $10 likely

Thursday, June 30, 2016 12:07 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary