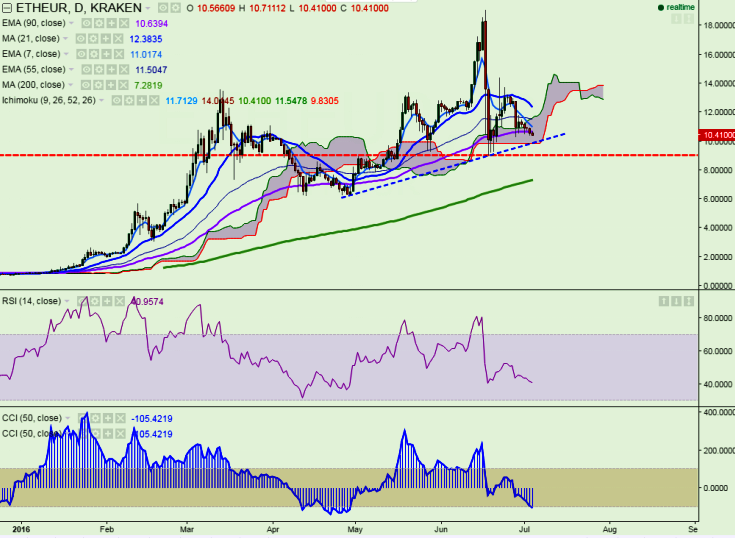

ETH/EUR is struggling to break above and seen trading in red on Monday. The pair has retreated after making a high of 10.38 levels (KRAKEN) yesterday. It is currently trading at 10.44 at the time of writing.

Ichimoku analysis of daily chart shows:

Tenkan-Sen level: 11.77

Kijun-Sen level: 14.04

Trend reversal level - (90 4H MA) – 10.64

Long-term trend remains to be bullish. The short-term trend seems to be bearish. In daily chart, ETH/EUR is trading well below Tenkan-Sen and Kijun-Sen. So a decline till 9 is possible.

Major resistance can be noticed at 11.21 (7 days EMA) and any break above that level will take the pair till 11.77 (daily Tenken-Sen)/12.62 (21 days MA). Short term support is seen at 10.29 (Jun 28th low) and any violation below will drag the pair till 9.58 (trend line joining 6.27 and 9)/ 9 (Jun 18th low).

ETH/EUR struggles to break above 12, decline till 9 likely

Monday, July 4, 2016 11:45 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary