Deflation and rampant unemployment, coupled with dropping manufacturing data signal that the eurozone is not in the best of health. This has significantly raised expectations for additional ECB stimulus, making this week's ECB meeting (Thursday) the market's key focus. Withering of US rate hike expectations, coupled with an uncertain EM outlook, has forced the ECB to come off the fence and prepare for an expansion of its existing QE programme.

Notwithstanding recent statements by ECB members, the most likely scenario, is a continuation of the dovish rhetoric, followed by the announcement of a QE time extension in December. Given additional stimulus expectations as early as this week, there is a risk for EUR/USD to squeeze higher should President Draghi withhold any signals regarding further policy measures. A stronger EUR would only exacerbate recent tightening, adding even further pressure on the ECB.

"The ECB's October meeting is for watching. Draghi's message will be dovish, but it's not time to act yet", said Holger Sandte, chief European analyst at Nordea Bank.

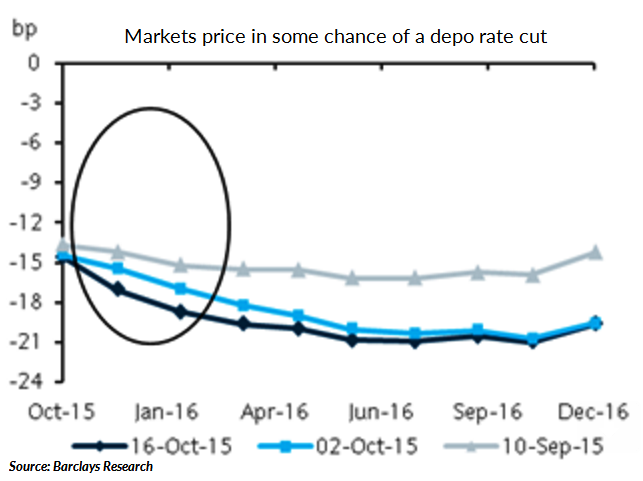

ECB governing council member Ewald Nowotny said last week that the ECB is missing its inflation target and will have to ramp up stimulus measures, adding, additional sets of instruments are necessary. Moreover, recent price action in front-end euro rates suggests that the market is pricing a non-zero probability for a further deposit rate cut. Although a measure of last resort, such policy action would be most effective in weakening the EUR.

"While we do not rule out this possibility, we do not think it is an option for the next two meetings. However, we estimate that the rates market is already pricing a 20% likelihood of a 10bp deposit rate cut before year-end. In our view, a likely trigger for a rate cut would be a further material appreciation of the euro, possibly related to more signs that the Fed will remain on hold for longer", said Barclays in a research note.

There is little data worth mentioning this week. The euro area flash composite PMIs (Friday) are expected to moderate further in Oct, as the manufacturing and services sectors post slight drops (to 51.5 and 53.2, respectively). There should be some decline in German confidence due to the emerging market slowdown, and the VW scandal. In France, volatility should remain, with PMIs consolidating slightly after last month's rebound.

EUR/USD edges lower from previous week's highs of 1.1494, and is trading around 1.1341 as of 0930 GMT. The pair remains supported amid broad based US dollar weakness as markets continue to weigh uncertainty over the timing Fed rate hike amid mixed US economic data.

ECB deposit rate cut by year-end cannot be ruled out

Monday, October 19, 2015 9:44 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist