While investors are exercising caution over US equity market as rate hike looms large, money is pouring into world equity market driven by optimism over European Central Bank (ECB) and Bank of Japan's (BOJ) monetary easing.

Both the central banks are easing at record pace, even if the pace is not raised any kind of tapering or scale back in purchase seems too far-fetched idea.

- According to Reuters's resources investors are overweight European and Japanese equities this year. Despite recent selloffs in the equity market, Eurostxx50 has returned 13.5% so far this year, while Japanese counterpart Nikkei225 has returned close to 17% so far compared to 1.5% by their American counterpart.

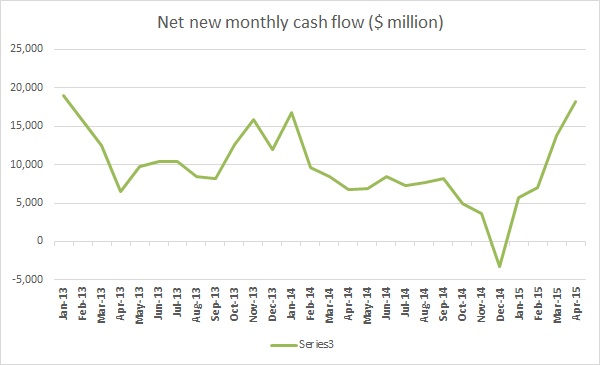

- While US equity market mutual funds are seeing massive with drawls so far this year, world market has seen not a single month of net withdrawal. After investors poured almost $45 billion to world equity till April 2015 from January, Investors poured another $15 billion in May.

As of now equity market is going through a phase of correction as probable FED rate hike dates close in. however, European equities still have long way to go, given their lower valuation compared to US counterparts.

ECB's stance along with weaker Euro creates the environment for recovery and Equities are most to gain from if recovery gathers pace pan Europe.

Eurostxx is currently trading at 3500, is likely to reach beyond 4200, however larger correction might take place as FED hikes rate.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary