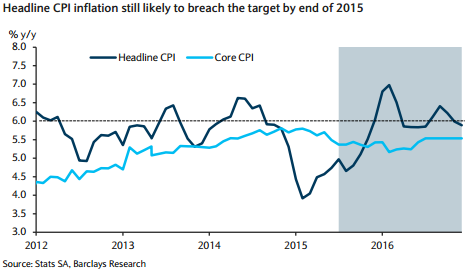

South Africa's July CPI data released this week showed headline CPI inflation rising to 5.0% y/y, 0.3pp higher than the June print. This was in line with consensus expectations. The higher headline CPI inflation took direction primarily from administered prices (mainly electricity and water) and fuel.

Meanwhile, core CPI inflation surprised to the downside for a second consecutive month, printing at 5.4% y/y, its lowest level since February 2014 and slightly below the 5.5% y/y recorded in June and against the expectation of an unchanged level.

"The two undershoots on core CPI inflation pull down the inflation trajectory forecasting and raise risks to the call that the next rate hike will come before the end of the year. We continue to call for 25bp in November and are comfortable, given the data, in forecasting no change at the September MPC", foresees Barclays.

Downside surprise in South Africa core CPI reduces probability for another hike

Friday, August 21, 2015 4:58 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX