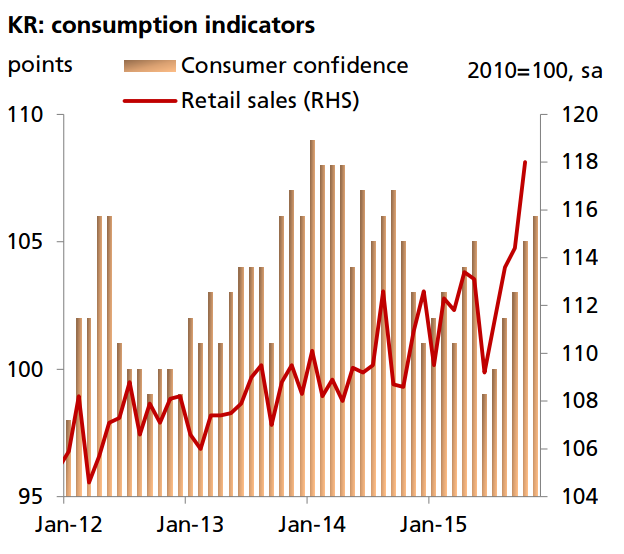

South Korea's domestic demand is gathering pace thanks to the stimulus effects of monetary and fiscal policy easing. Retail sales registered a very strong rise of 3.1% (MoM sa) in Oct. Consumer confidence index picked up for the fifth consecutive month in Nov, staying firmly above the neutral level of 100.

By contrast, the recovery in external demand remains weak and fragile. Although the year-on-year decline in exports narrowed to -4.7% in Nov from -15.9% in Oct, it was mainly helped by the low comparison base last year. Industrial production, meanwhile, fell again in Oct after a temporary rebound in Sep.

Based on this first set of data for the OctDec period, a 3% (QoQ saar) growth is achievable for 4Q. This is lower than the longterm trend rate of 4%, but pretty much in line with the central bank's expectations. Unless growth results significantly deviate from official assumptions, the BOK is expected to hold rates steady at the present level of 1.50% over the next six months.

Domestic demand remains the key driver in South Korea

Tuesday, December 1, 2015 1:38 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal