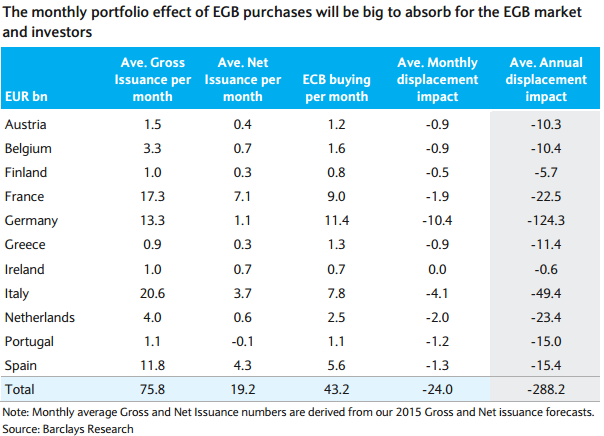

The key takeaway for the EGB market is that c.€45bn per month in EGB purchases for at least 19-months is a very large number for the EGB market and its investors to absorb. Therefore, the portfolio squeeze effect of the purchases could be quite large.

Barclays notes in a report on Monday:

- We conclude that ECB buying will outweigh net issuance for each of the sovereigns and displace investors.

- The ECB is aiming to buy up to €850bn cash in EGBs during the whole programme in the eligible QE bucket (2-30y).

- This, together with our estimated €290bn net EGB issuance in this bucket over the course of the programme, means that the if ECB's QE is to meet its balance sheet expansion target, it will potentially displace €560bn from the EGB investors.

- Even in the recent purchase operations, where the Fed has focused on the long end, private investors did not have to lower their holdings of longend Treasuries.

- As such, the ECB's purchase programme is more likely to resemble the Japan experience under QQE, where annual purchases of ¥50trn (later scaled to ¥80trn) far exceeded annual net issuance of around ¥38trn.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed