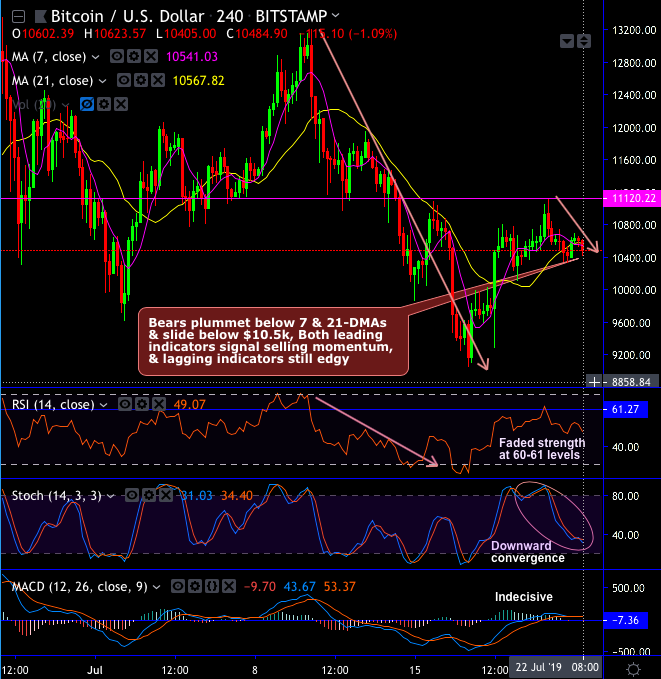

Bitcoin spiked higher in July but struggling for the momentum, surged from $9,049 to the recent highs of $13,200 levels. While bears plummet below 7 & 21-DMAs, consequently, the pair slid below $10.5k. Both leading indicators signal overbought momentum that indicates the selling sentiments and lagging indicators still edgy.

The intermediate trend from the lows of $3,122.28 levels to the June highs of $13,880 levels which is almost more than 344% so far (in just 6-7 months or so).

Technically, after BTCUSD has bottomed out at $3,122.28 levels, consequently, the bullish engulfing pattern has occurred at $4,071.70 levels (refer monthly chart).

Ever since then the pair kept spiking higher constantly, it has now gone above 21-DMAs Thereby, the pair hits the psychological price levels of the $5k mark. Followed by, the majority of the crypto fraternity experienced the middling performance with a few select altcoin markets surging strongly. To substantiate this bullish sentiment, all technical indicators are in line with the price upswings.

Both RSI and Stochastic curves show upward convergence to the prevailing rallies that indicate the intensified buying momentum.

Some position proxy suggests that Bitcoin is still overbought despite some position reduction in July.

After peaking at the end of June, Bitcoin has been struggling in July raising questions about overbought conditions.

To address this question, we resort to futures contracts and in particular, the two most important Bitcoin futures contracts: the CME futures contract and the less regulated perpetual swap contract traded at Bitmex.

Both of these contracts are mostly driven by institutional investors. We argued before that the relative importance of institutional investors has structurally risen for the Bitcoin market over the past year as the previous cryptocurrency bubble of 2017 collapsed during last year, inducing many retail investors to exit the market.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential