Of late, Ethereum has been popular network utility. The blockchain has observed reinforced stablecoin issuance and a mounting influx of various ETH-driven DeFi projects.

With that fact, the underlying price of ethereum has held tight though it is sensing bearish pressure for the day. But this is just momentary as ETHUSD has been one of the best performers among the entire gamut of cryptocurrencies. Before pandemic Covid-19 circumstance that erupted especially during February and March 2020, it was all set for the highs of $300 levels. The pair rallied up to $290, the buying sentiments were higher than ever as it kept rallied 9-consecutive months by then.

For now, the prevailing trend of this pair is something of that sort as it surpassed $250 level.

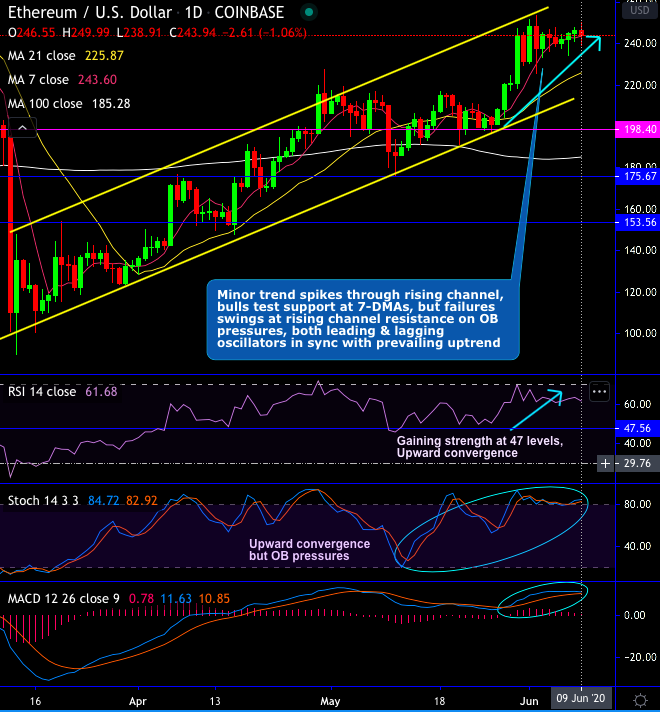

Technically, the minor trend spikes through rising channel, bulls test support at 7-DMAs. But failures swings at rising channel resistance on overbought pressures, both leading & lagging oscillators are also in sync with the prevailing uptrend (refer daily chart).

While bulls take-off rallies above EMAs upon strong support, stiff resistance observed at trend line, more rallies likely only on breakout, both leading oscillators (RSI & stochastic curves) signal intensified buying momentum (refer weekly plotting).

Fundamentally, the main driving force is that the utility growth Ethereum has seen over the past five months has led ETH to see booming demand, as more investors begin recognizing its growing potential.

Coupled with this driver, we witness a considerable spike in the cryptocurrency’s hash rate that has soared by 27% since the beginning of the year, while the launch of Ethereum 2.0 in a few weeks.

Overall, Ethereum has been outperforming any other crypto-peer, with high trading volumes.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge